A Guide to Big Questions in Macroeconomics

Overview

Part I: Economic Growth

Why are some countries rich and others poor?

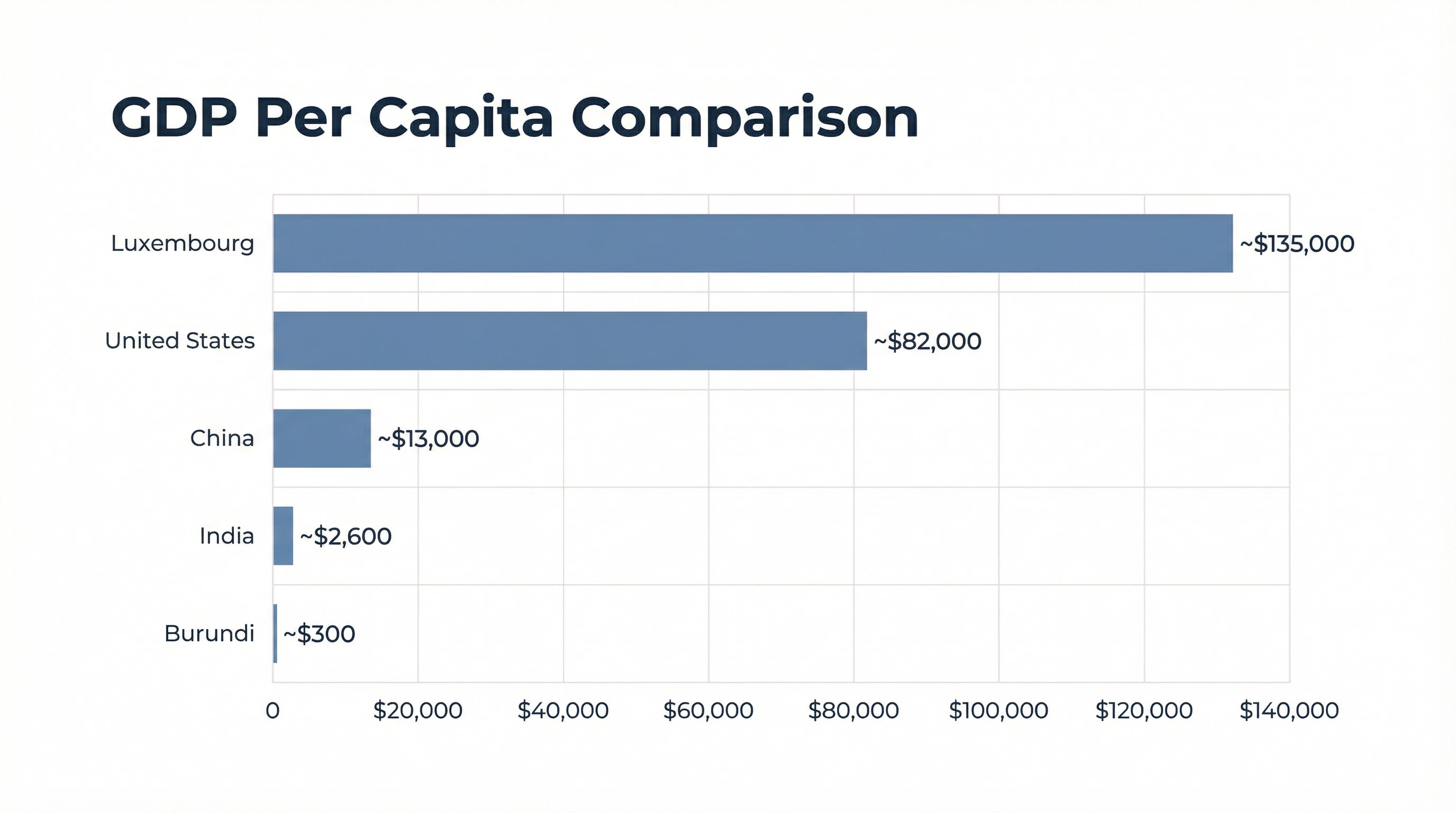

The Income Gaps

GDP Per Capita Comparison

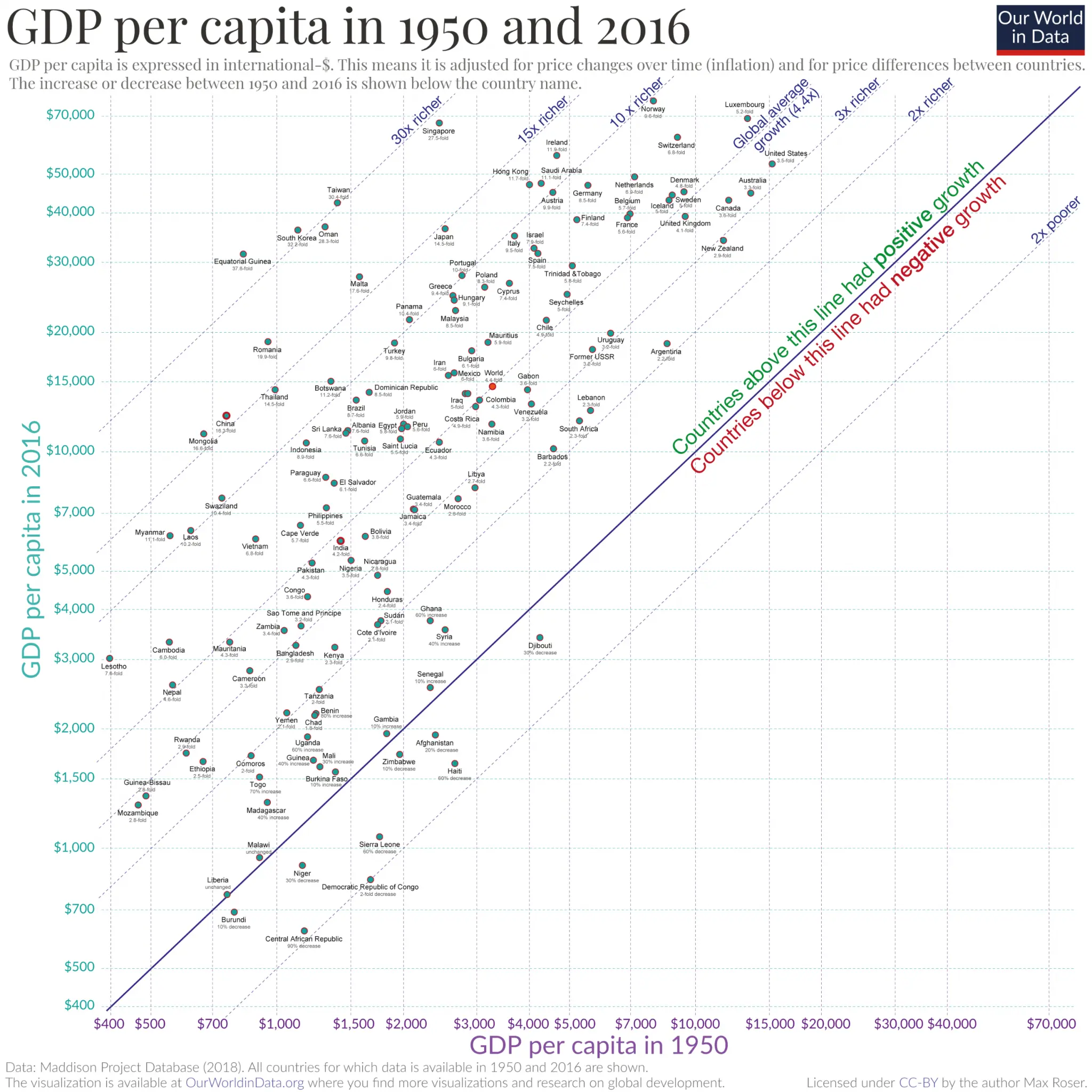

Growth Trajectories

GDP per capita in 1950 and 2016

Full Chart

Click to zoom into any area

The Lucas Question

The staggering consequences of growth

"I do not see how one can look at figures like these without seeing them representing possibilities. Is there some action a government of India could take that would lead the Indian economy to grow like Indonesia's or Egypt's? If so, what exactly? If not, what is it about the "nature of India" that makes it so? The consequences for human welfare involved in questions like these are simply staggering: once one starts to think about them, it is hard to think about anything else."

— Robert Lucas (1988)

Total Factor Productivity

It's not just capital, it's efficiency

Barriers and Spillovers

Technology adoption and knowledge spillovers

Part II: Business Cycles

Booms, Recessions, and Stabilization

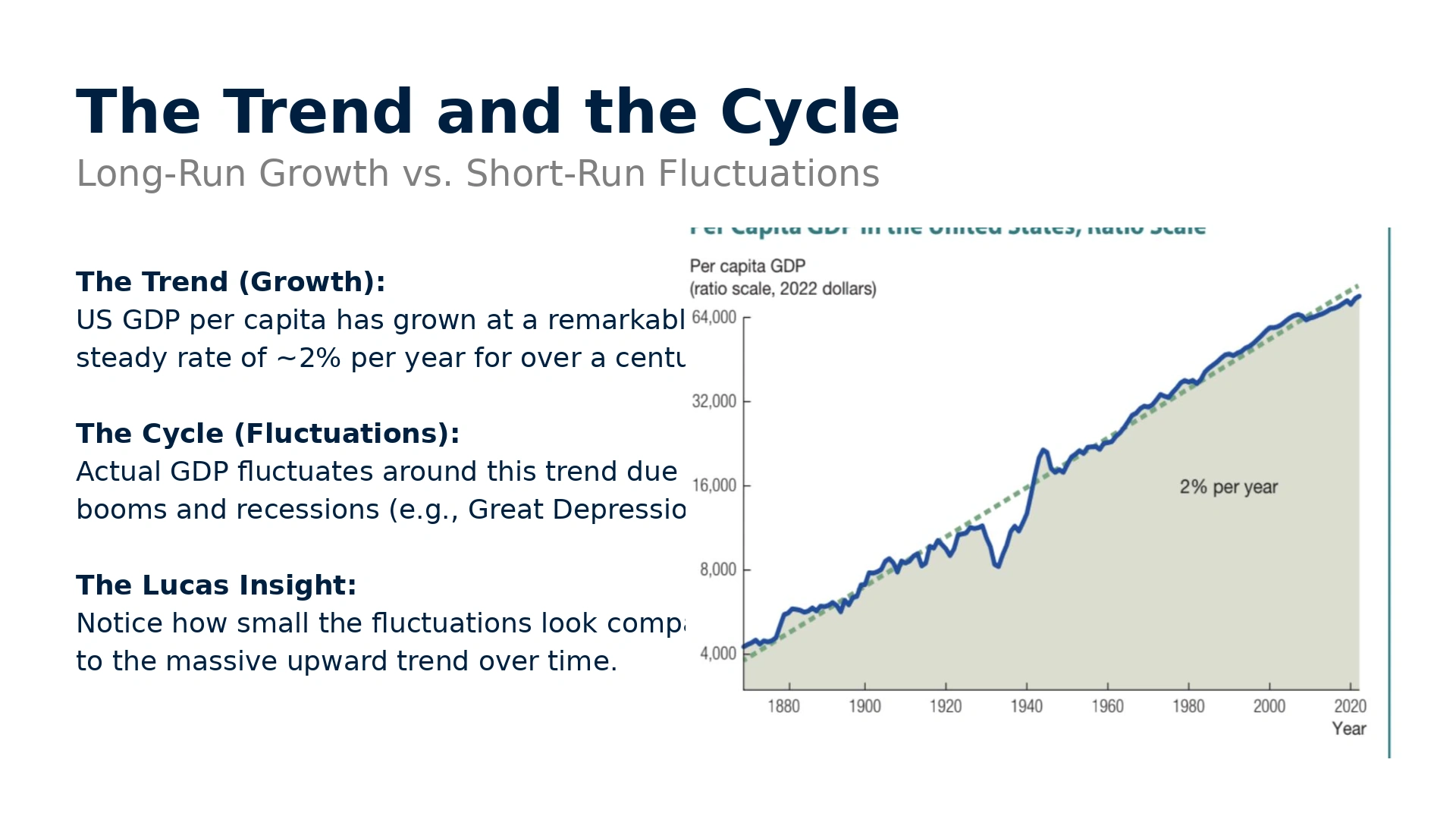

The Trend and the Cycle

Long-Run Growth vs. Short-Run Fluctuations

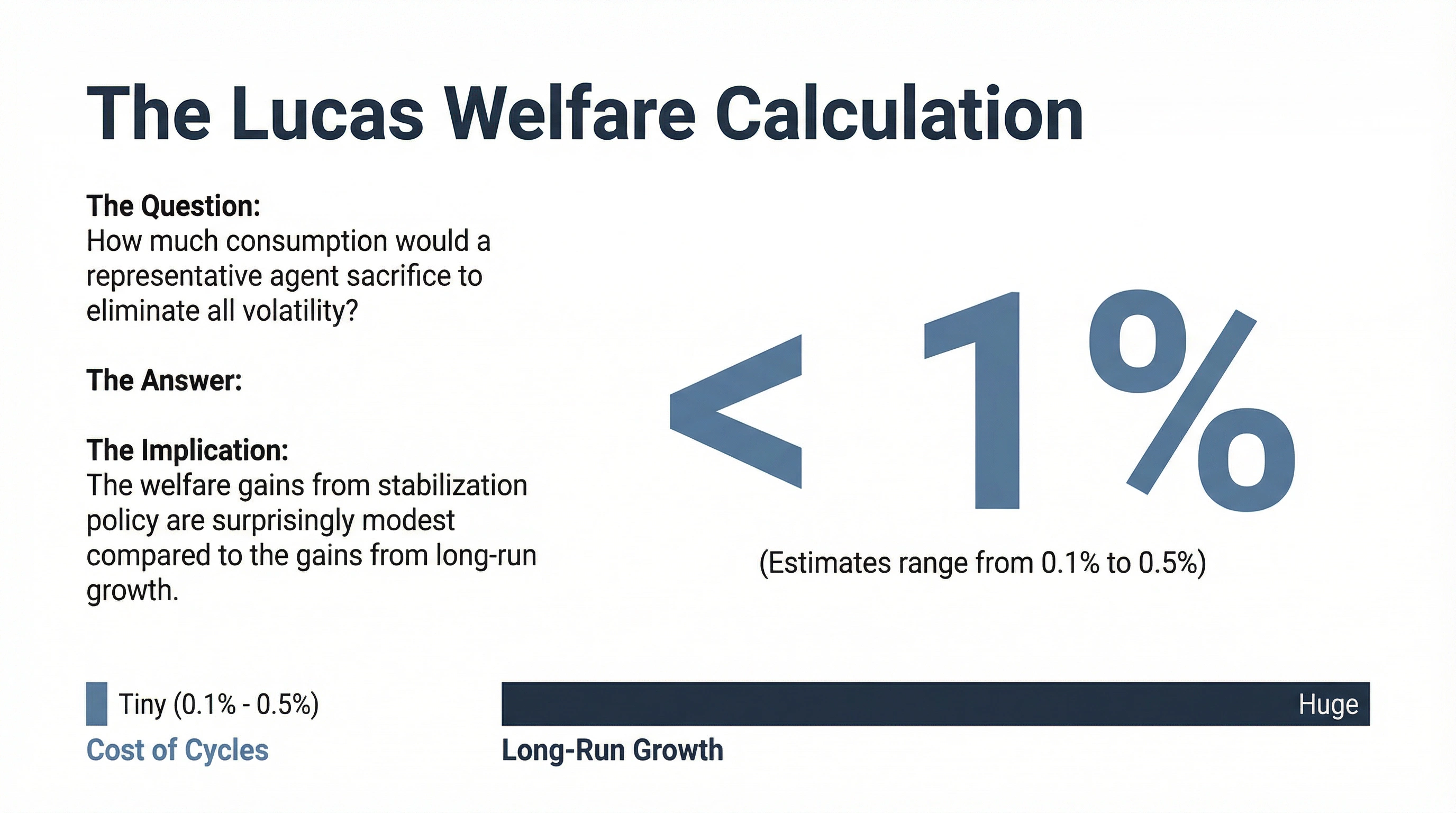

The Cost of Cycles

Surprisingly small compared to growth

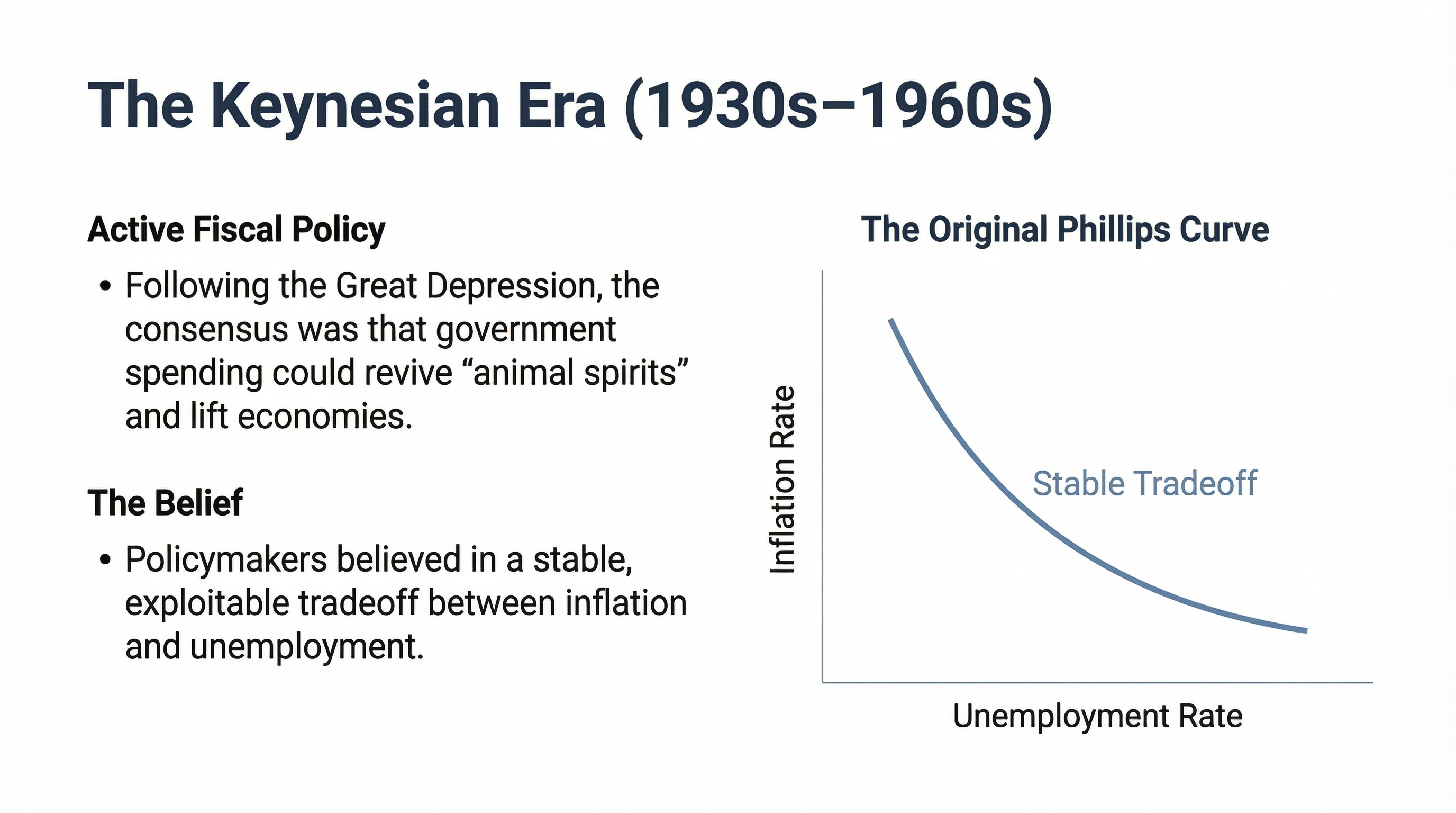

The Keynesian Era

The belief in a stable tradeoff

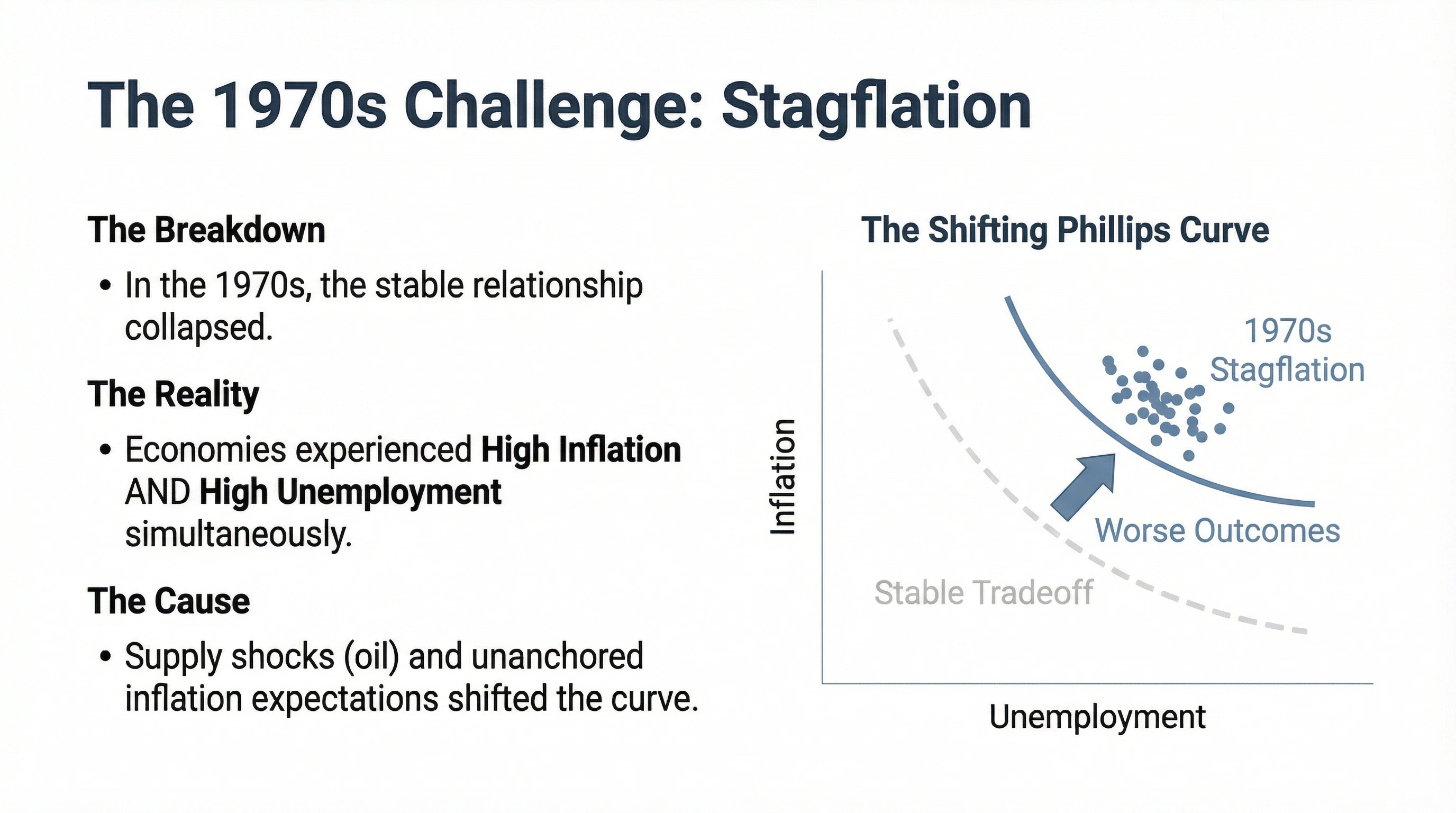

The 1970s Challenge

When the tradeoff collapsed

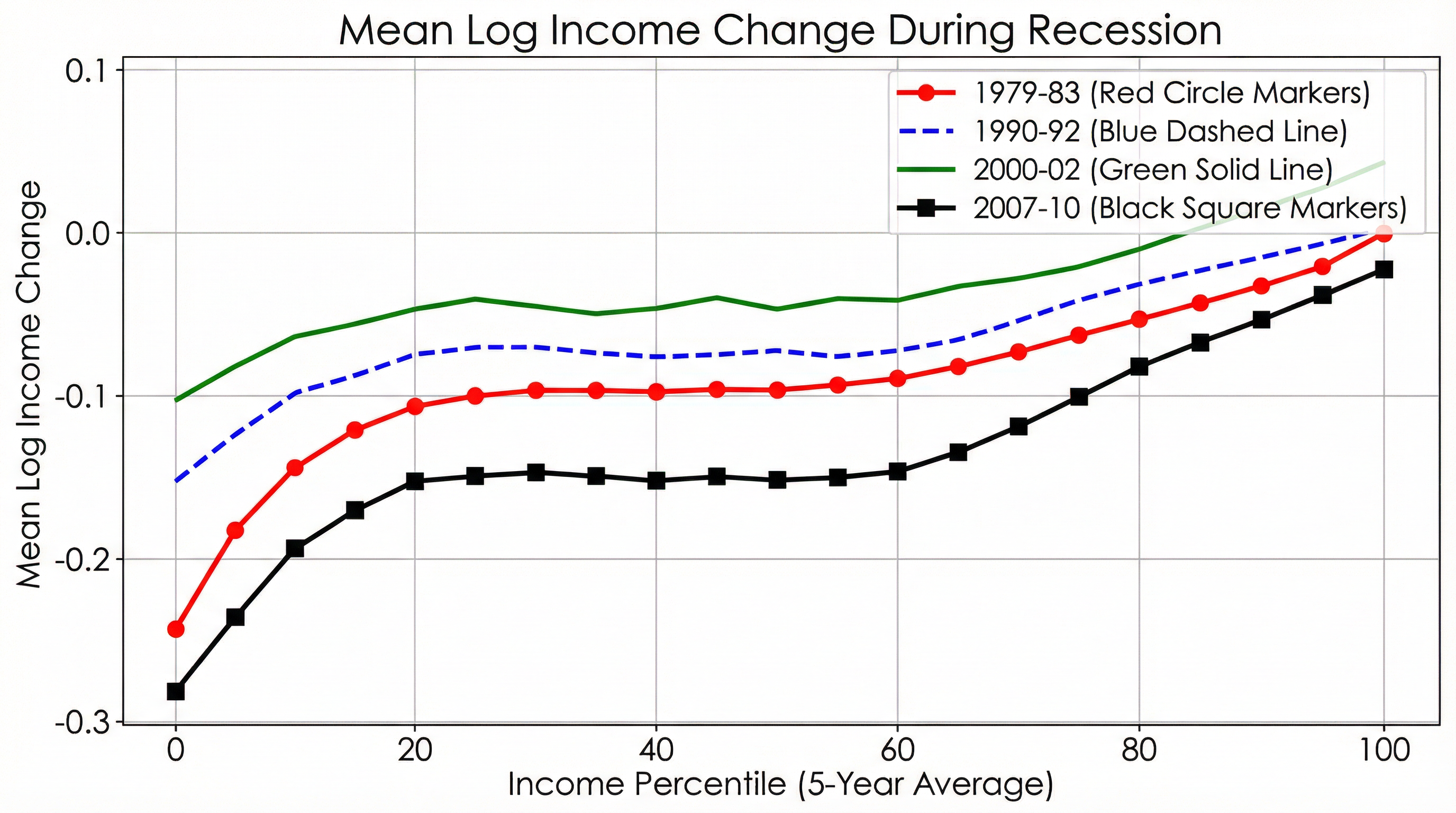

Unequal Recessions

Aggregate shocks are small in the data – standard deviation of output ≈ 3% in the U.S.

Small welfare gains from conventional stabilization policies

Burden of shocks is shared highly unequally

Large welfare gains from insurance

Insurance rather than redistribution

Gains and losses for households roughly even out over business cycle

Part III: Inflation & Money

Prices, Central Banks, and Credibility

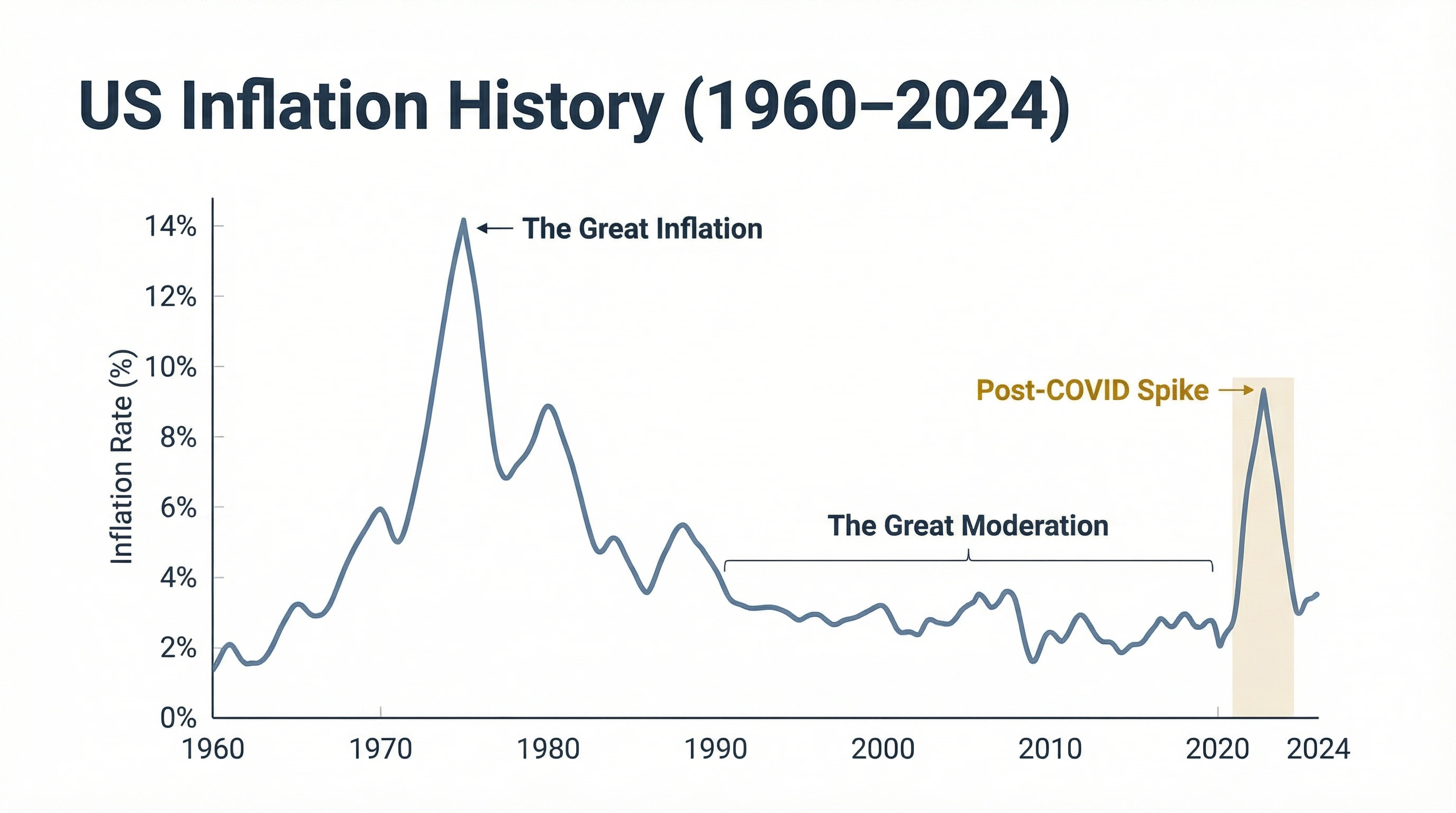

US Inflation History

From the Great Inflation to the COVID Spike

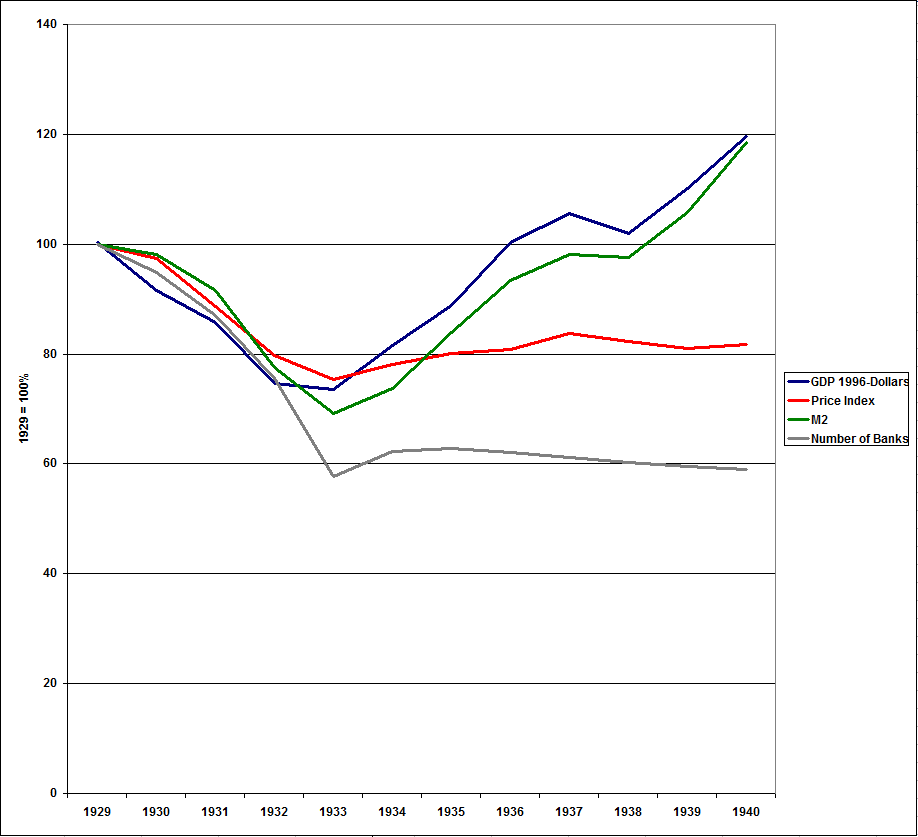

Monetary Policy in the Great Depression

The motivation for Friedman's work

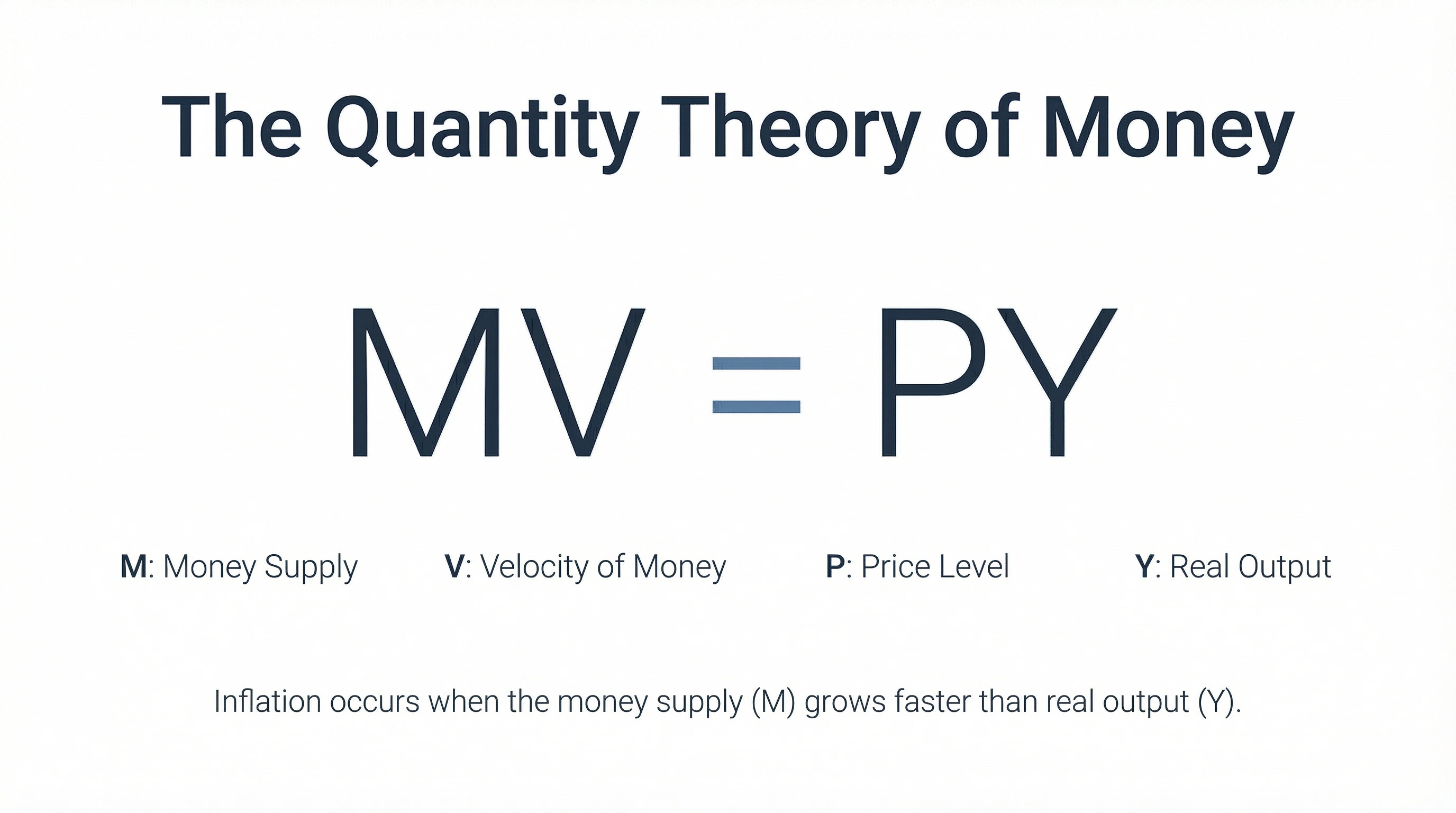

Quantity Theory of Money

MV = PY

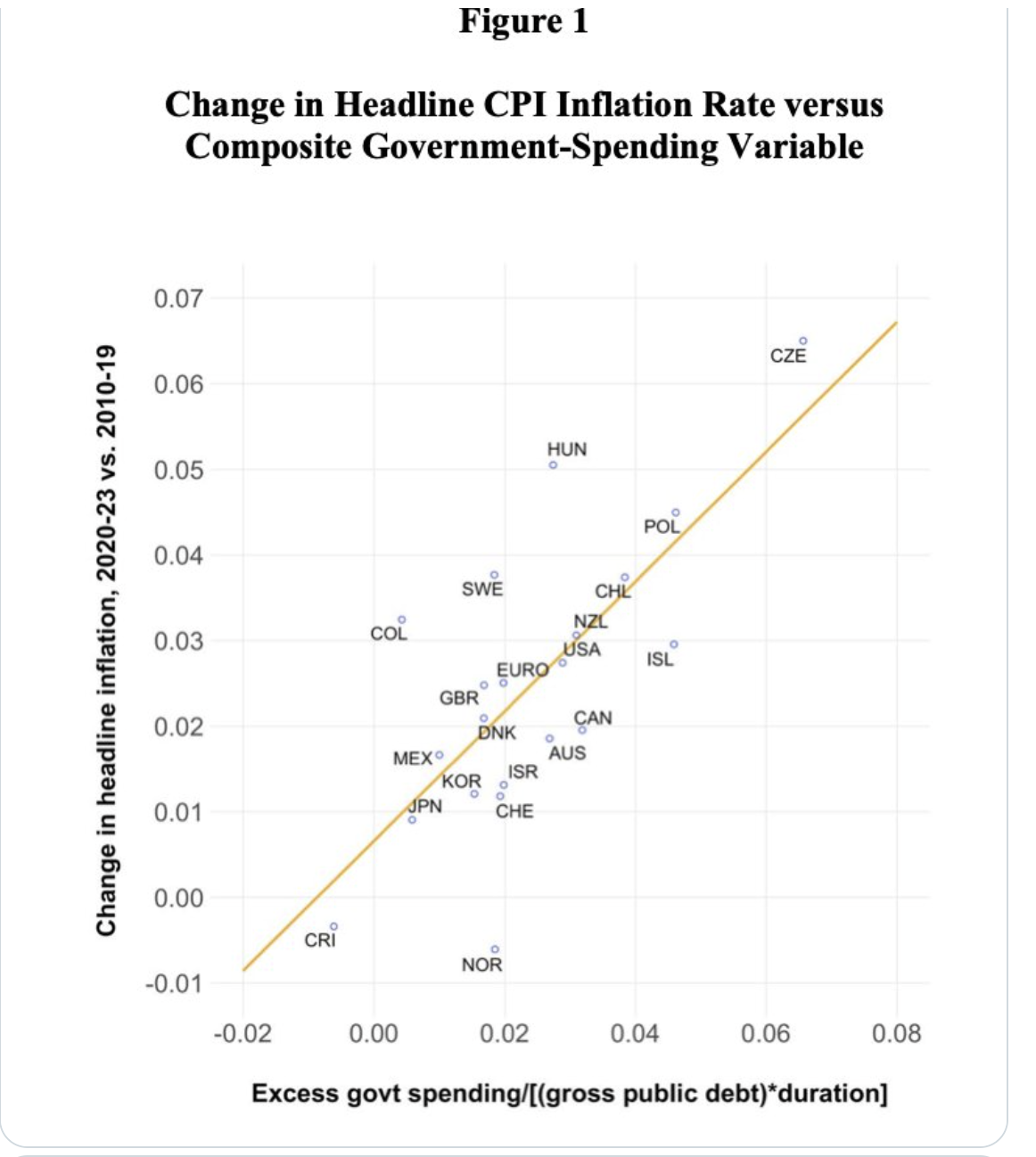

Government Spending and Inflation

Cross-country evidence from 2020-2023

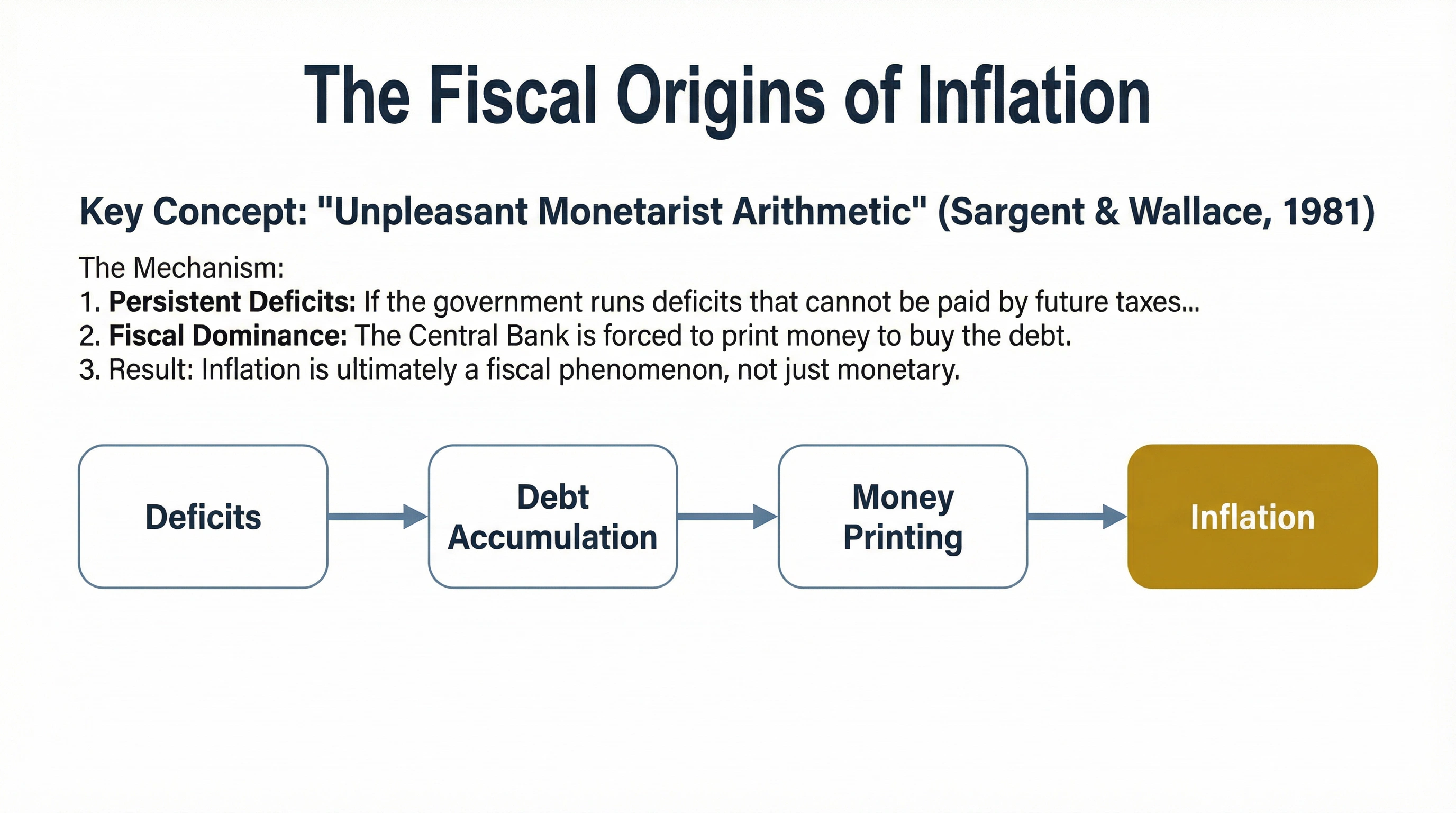

Fiscal Origins of Inflation

Unpleasant Monetarist Arithmetic

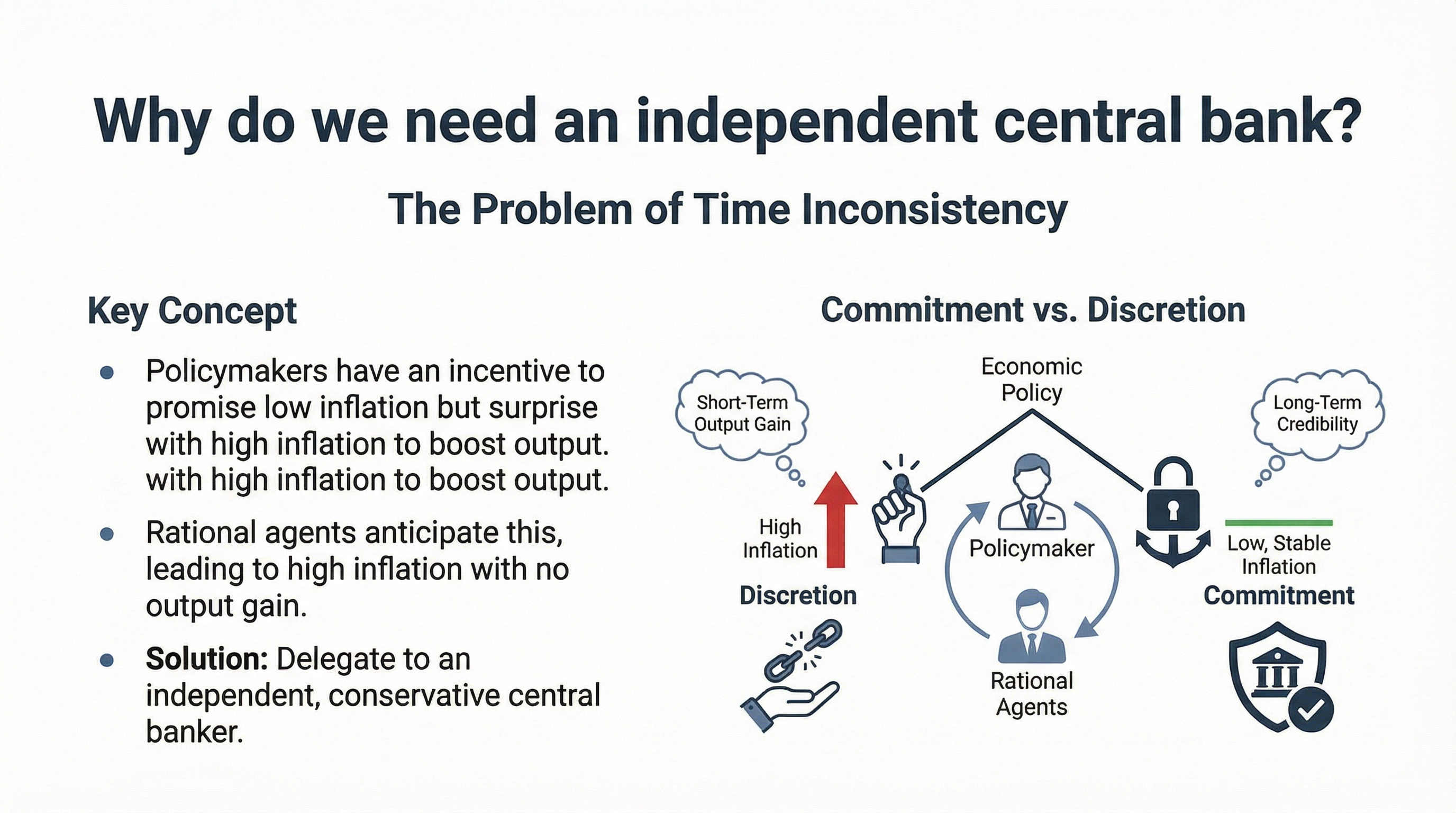

Why do we need an independent central bank?

The Problem of Time Inconsistency

Central Bank Independence

The solution to credibility

Open Questions in Inflation

Beyond traditional frameworks

Part IV: Inequality

Distribution, Technology, and Fairness

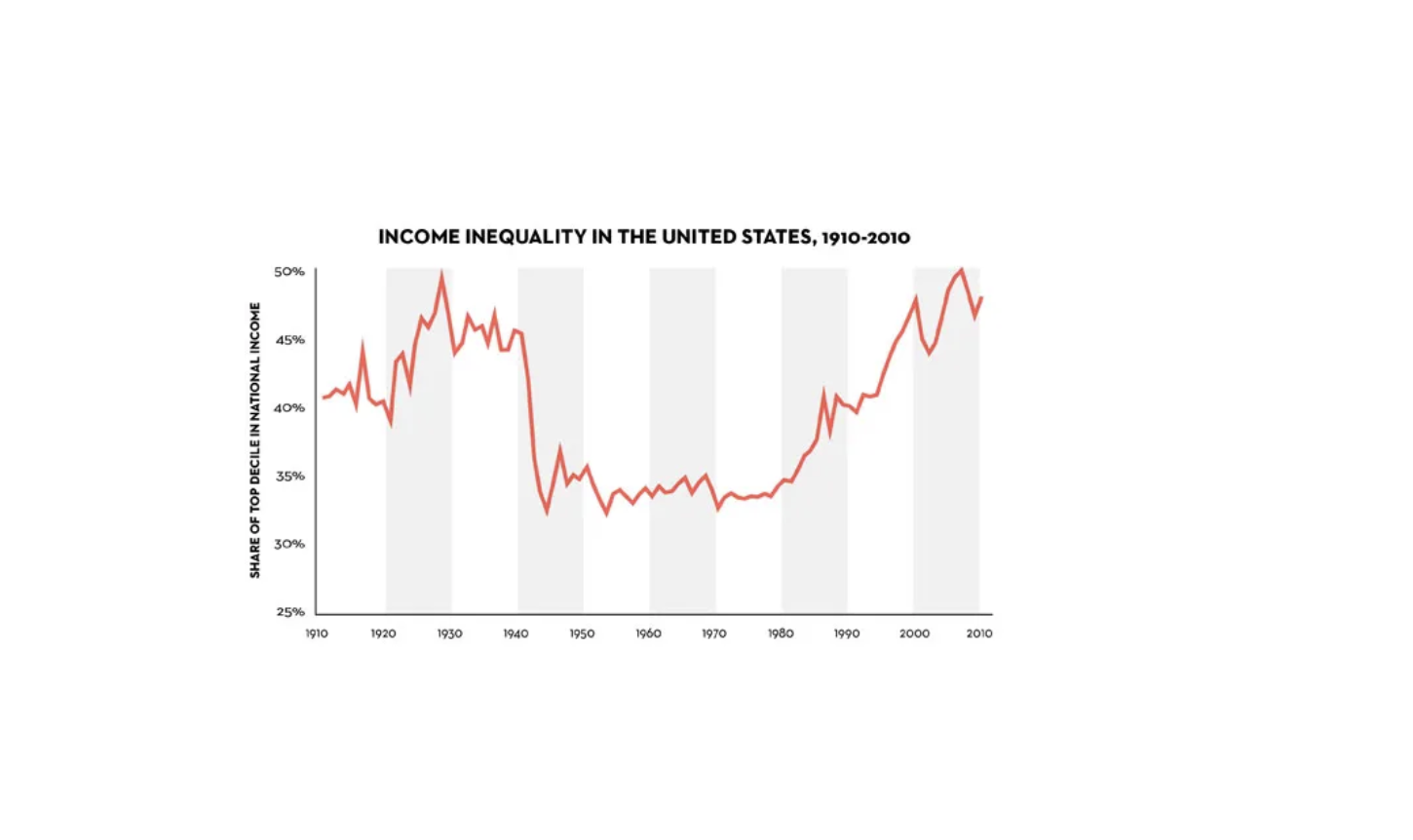

The Great Inequality Debate

Piketty's provocative findings on long-run inequality

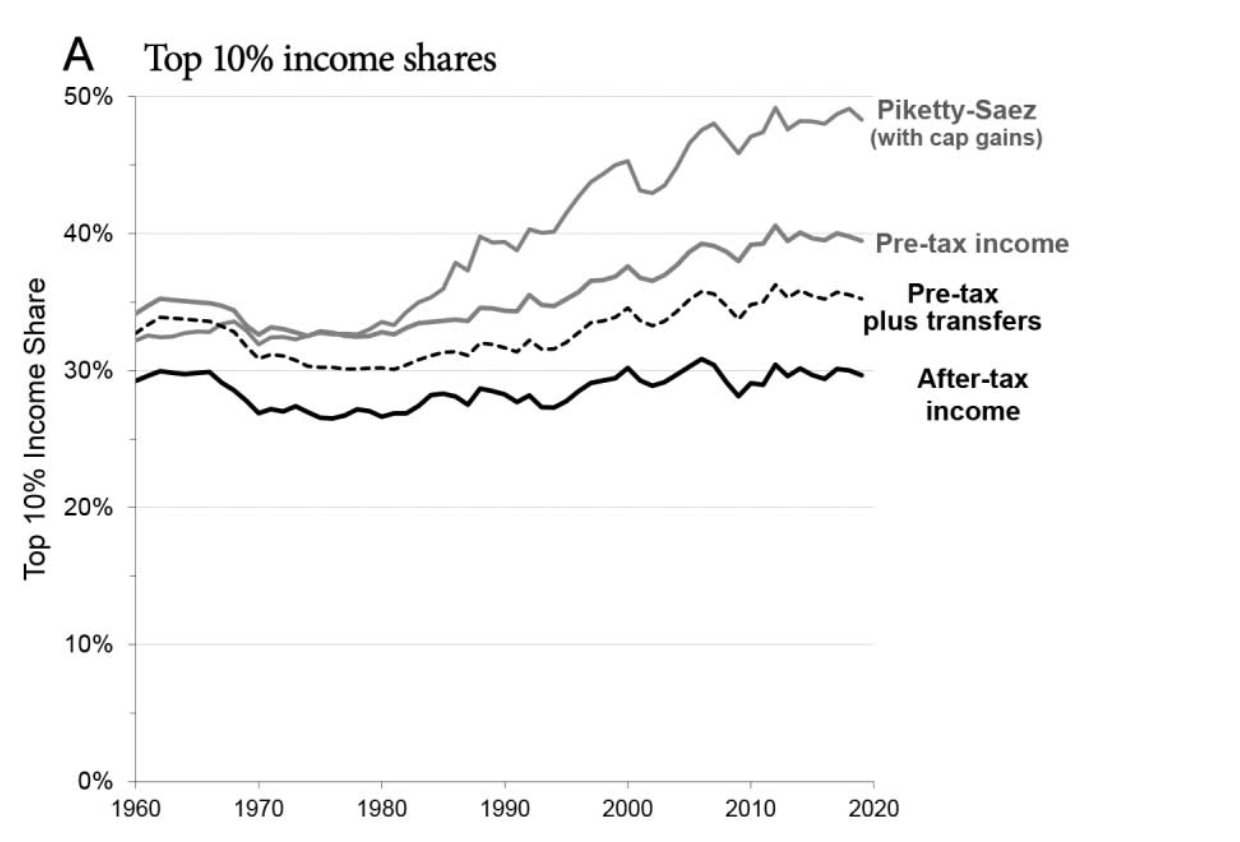

Measurement Matters: Top 10%

Piketty-Saez vs. Pre-tax Income with Transfers

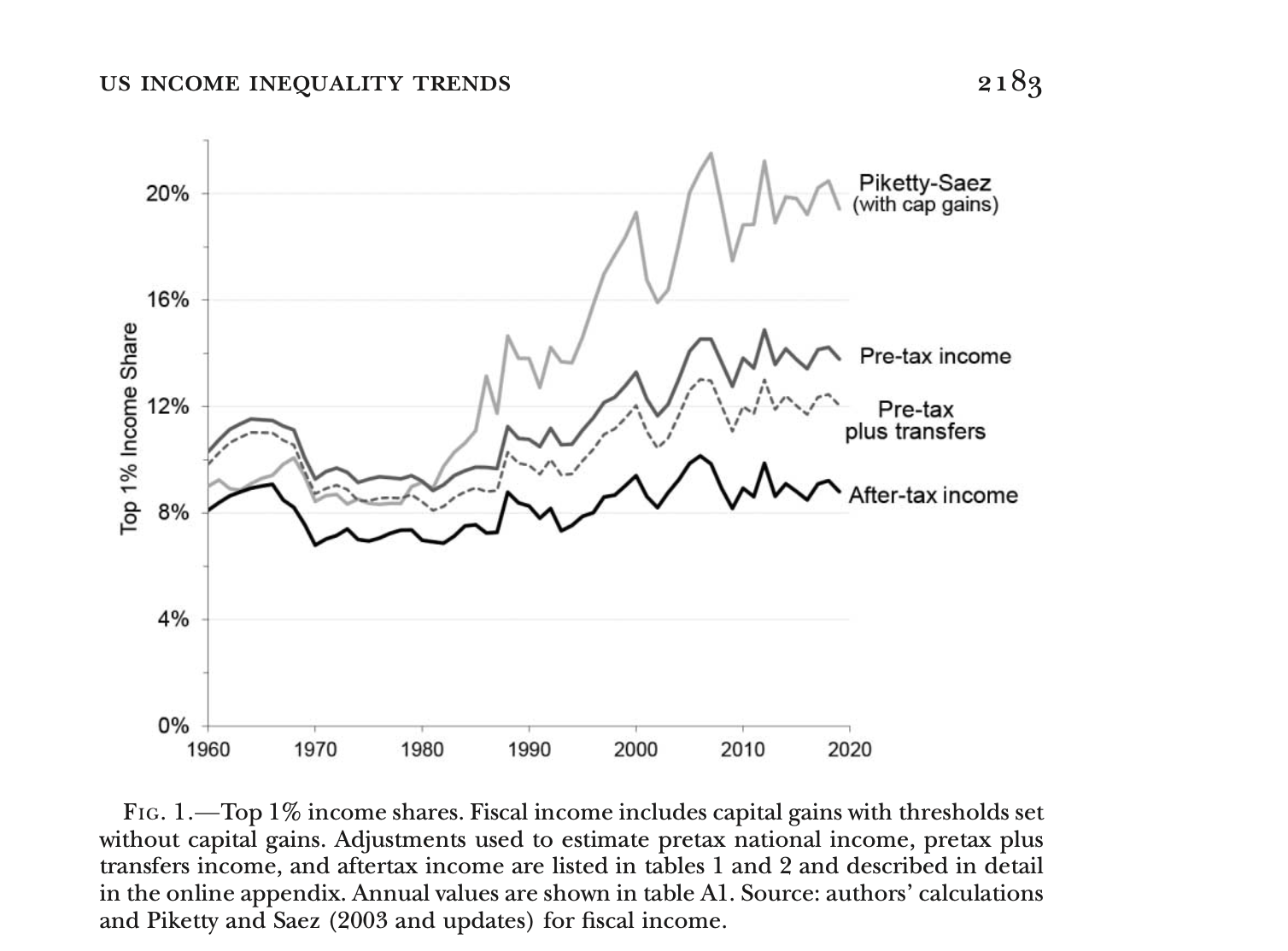

Measurement Matters: Top 1%

Auten & Splinter show Piketty overstates the increase

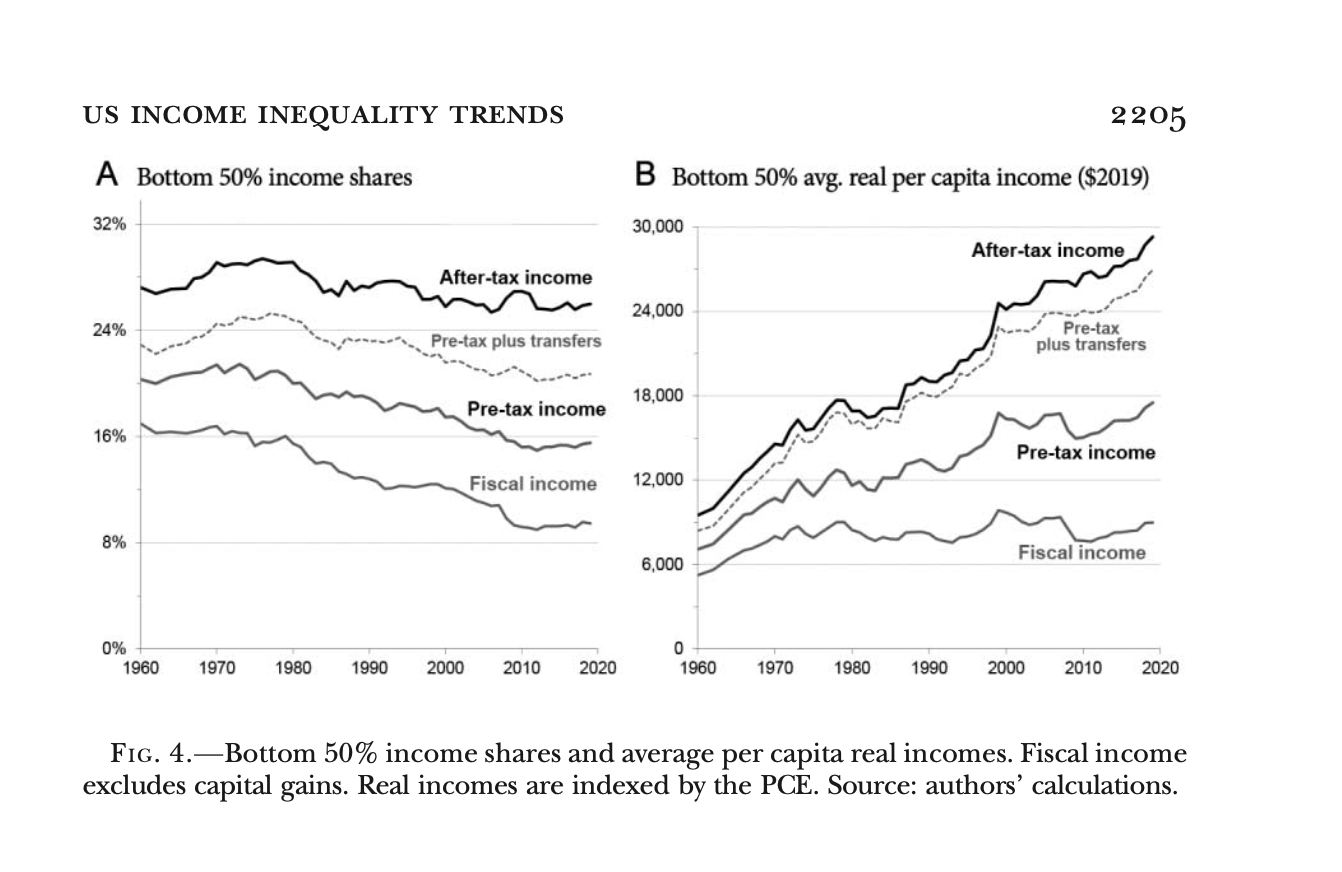

What About the Bottom 50%?

Income shares and real per capita income trends

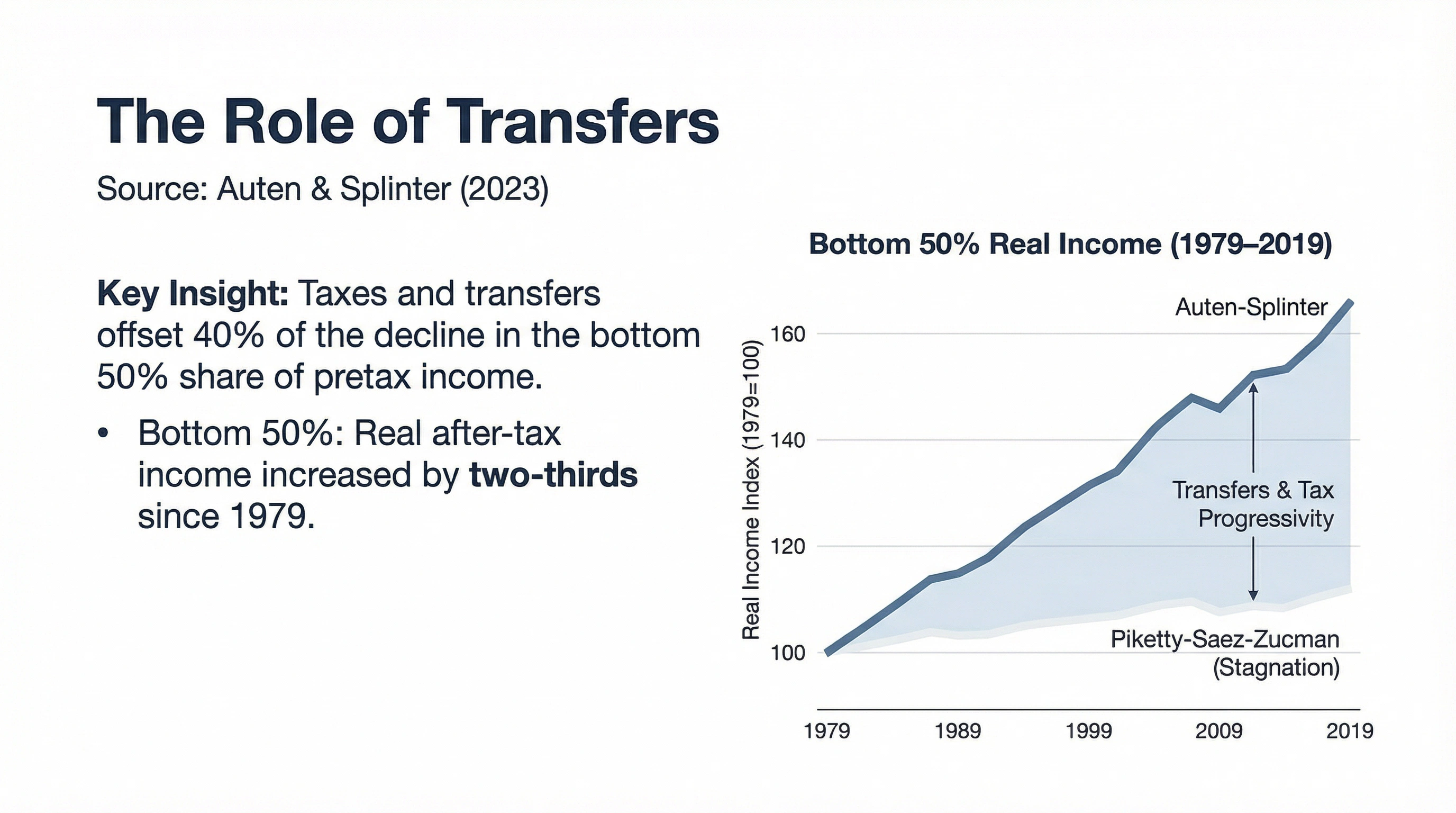

The Role of Transfers

Taxes and transfers offset 40% of pretax decline

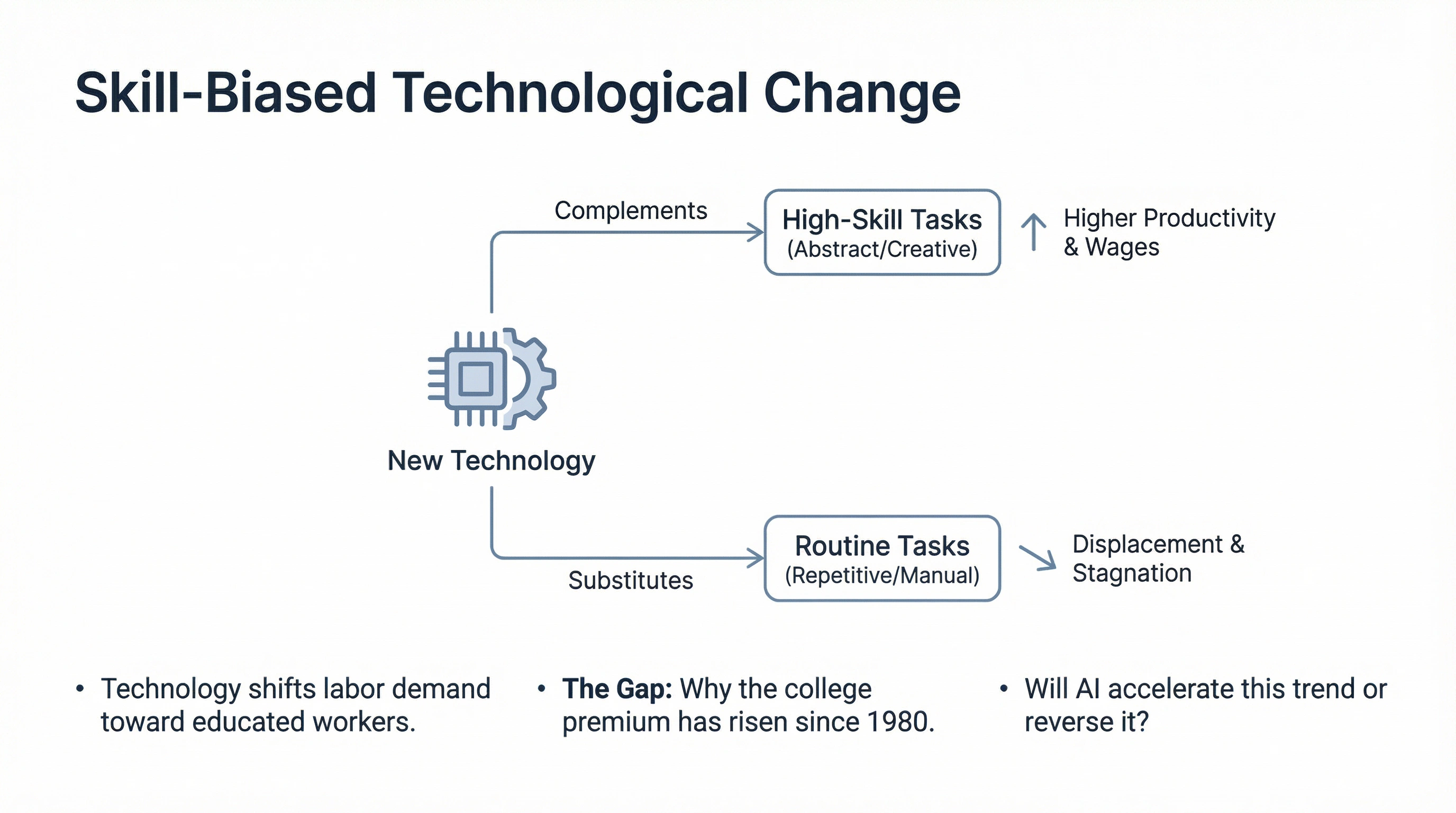

Skill-Biased Change

Technology and the wage gap

Desirability of Progressive Taxation

Balancing efficiency and equity

Open Question: Future of Work?

Will AI accelerate inequality?

Part V: Public Finance

Debt, Taxes, and Efficiency

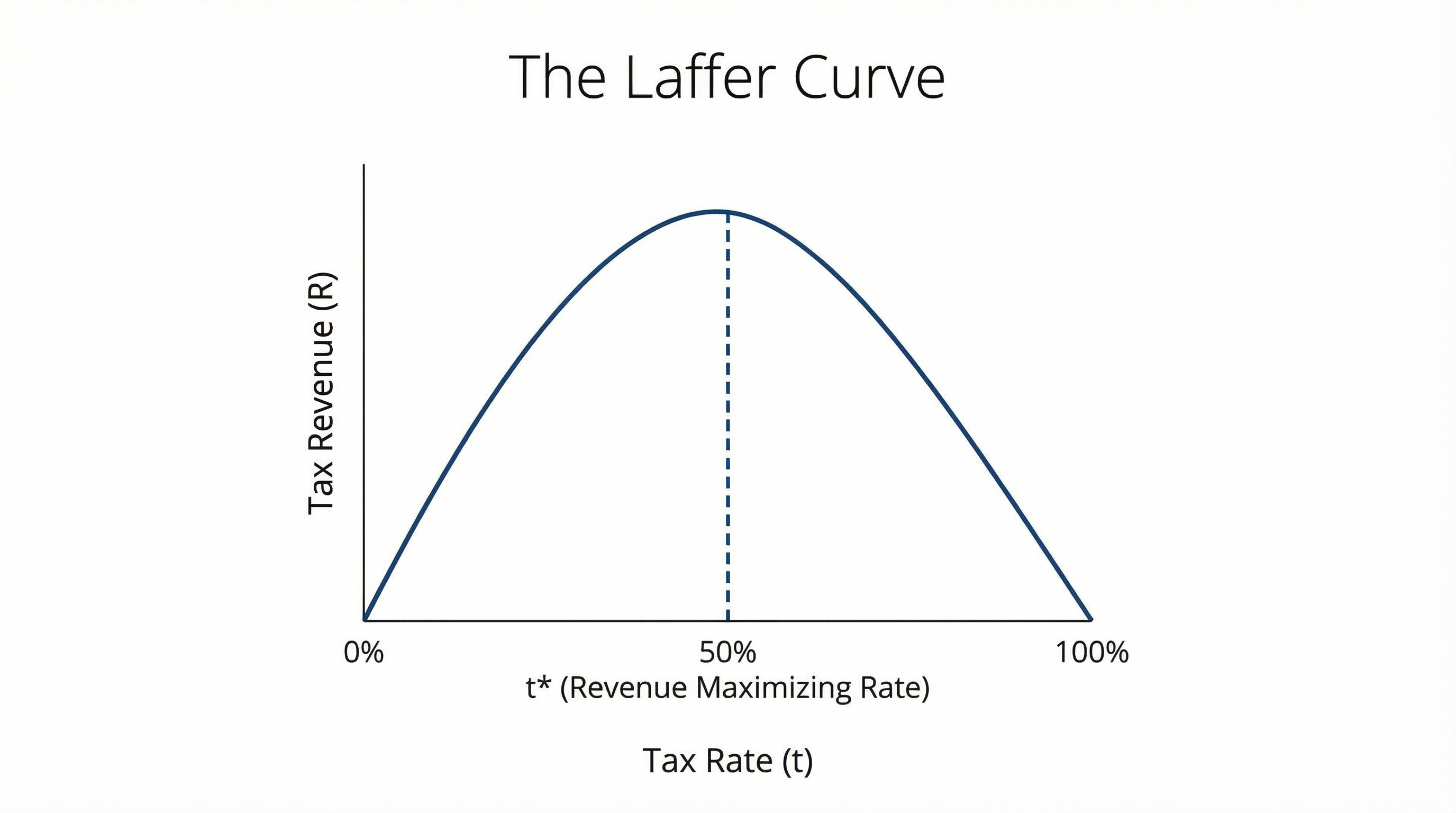

The Laffer Curve

Theoretical Limits of Taxation

Laffer Curve in Reality

Where are we now?

The curve implies a revenue-maximizing tax rate (t*).

Most empirical estimates suggest US rates are well to the left of t*.

Cutting taxes rarely pays for itself (e.g., 2017 Tax Cuts).

Exception: Very high marginal rates (e.g., >70%) may dampen revenue.

The VAT Puzzle

Feature or Bug?

Most developed countries rely heavily on Value Added Tax (VAT) for revenue.

The United States is a notable outlier: No federal VAT.

Is this a feature of our system or a bug?

How does this choice impact efficiency and revenue capacity?

The Revenue Challenge

Modern State in an Open Economy

Big Question: How can a modern state raise substantial revenue...

...in a globalized, open economy...

...without undermining productive efficiency?

We need a tax system that minimizes distortions to production decisions.

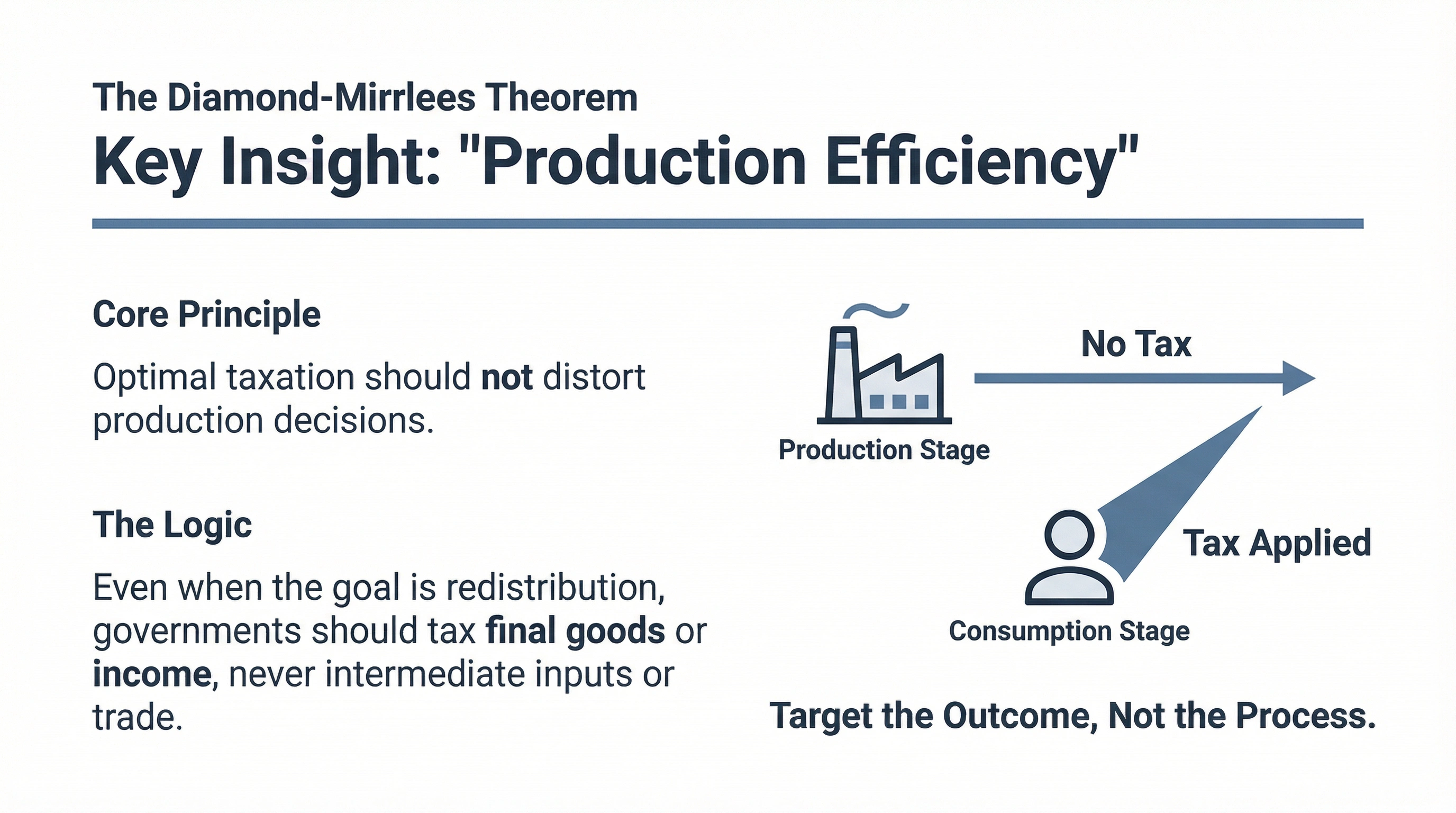

Diamond-Mirrlees Theorem

Production Efficiency (1971)

Policy Implications

What Diamond-Mirrlees Tells Us

Superiority of VAT: Taxes consumption without distorting intermediate production steps.

Desirability of Free Trade: Tariffs distort production efficiency; free trade is optimal.

No Taxation of Capital Income: Capital taxes distort intertemporal production choices.

Conclusion: Tax final consumption, not production inputs.

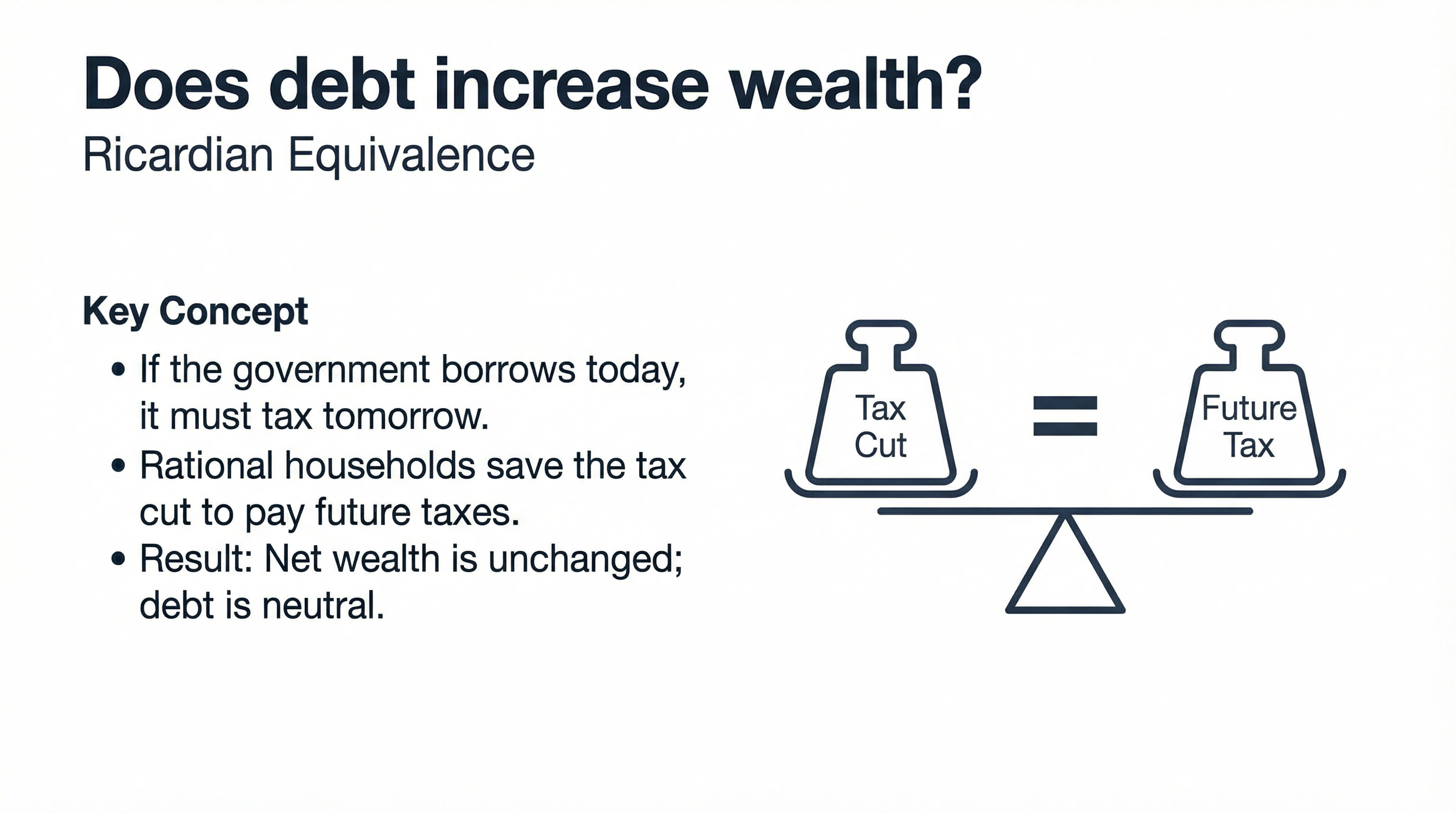

Does debt increase wealth?

Ricardian Equivalence

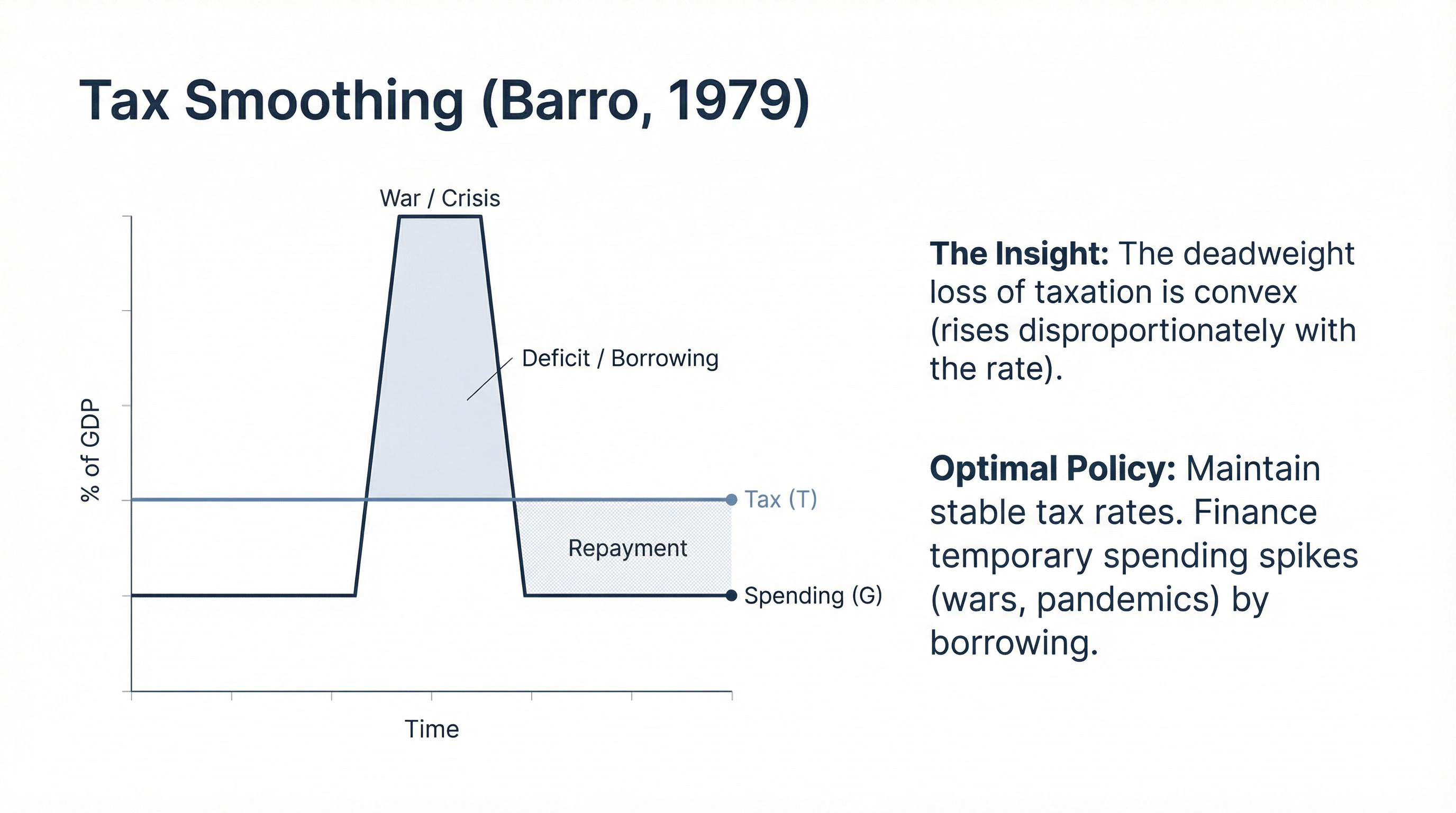

How to pay for wars?

Tax Smoothing and Deficits

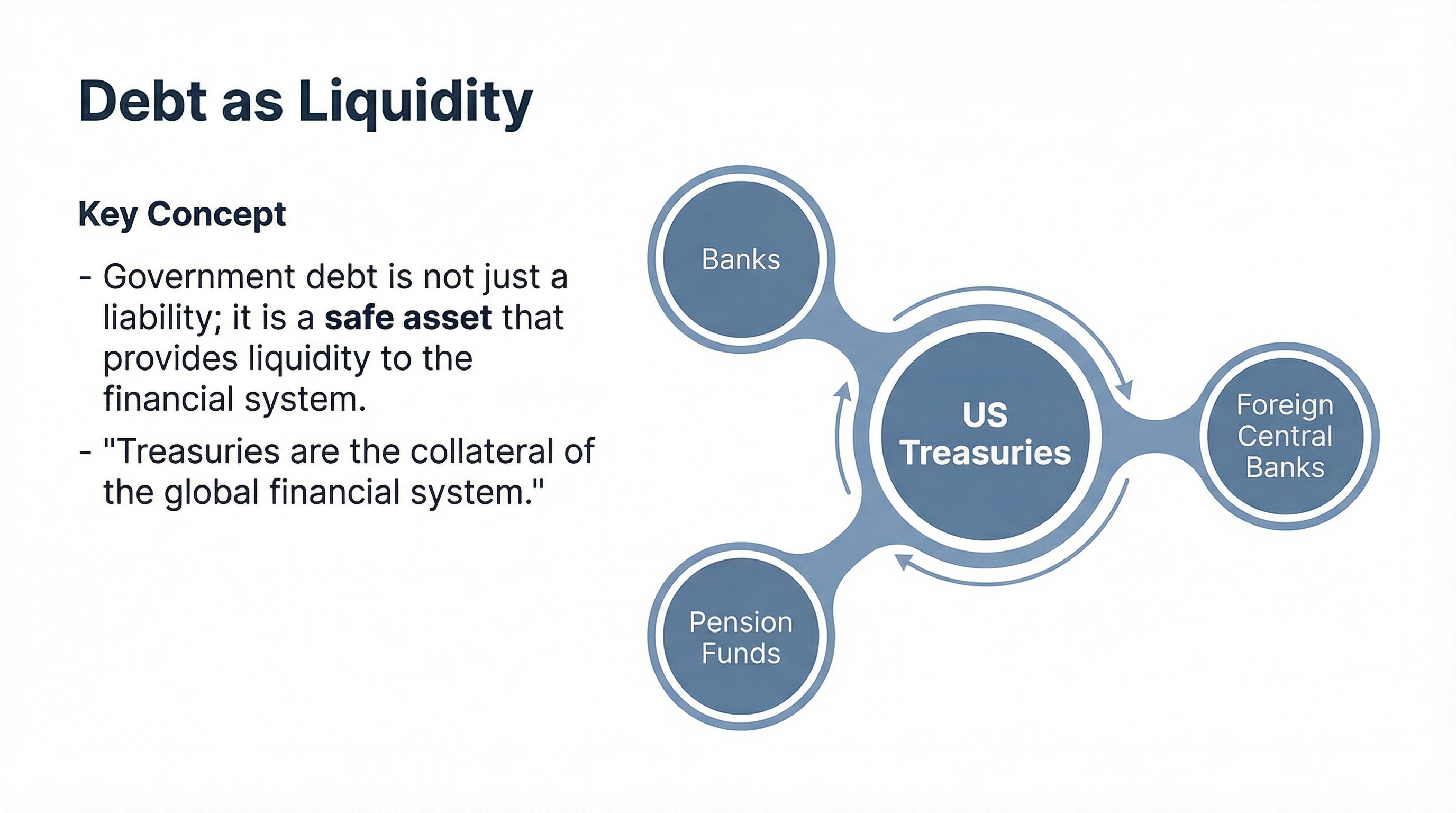

Debt as Liquidity

Treasuries as the global safe asset

The Looming Fiscal Crisis

Rising Debt

"I used to think that if there was reincarnation, I wanted to come back as the president or the pope... But now I would like to come back as the bond market. You can intimidate everybody."

— James Carville, Clinton Political Adviser

Debt-to-GDP is expected to exceed 150% over the next decade.

The Social Security Trust Fund is projected to be depleted by the early 2030s.

What are we going to do? Raise taxes or cut spending?

Part VI: Stock Market

Valuation and Concentration

Market Valuation

Market Cap to GDP & CAPE Ratio

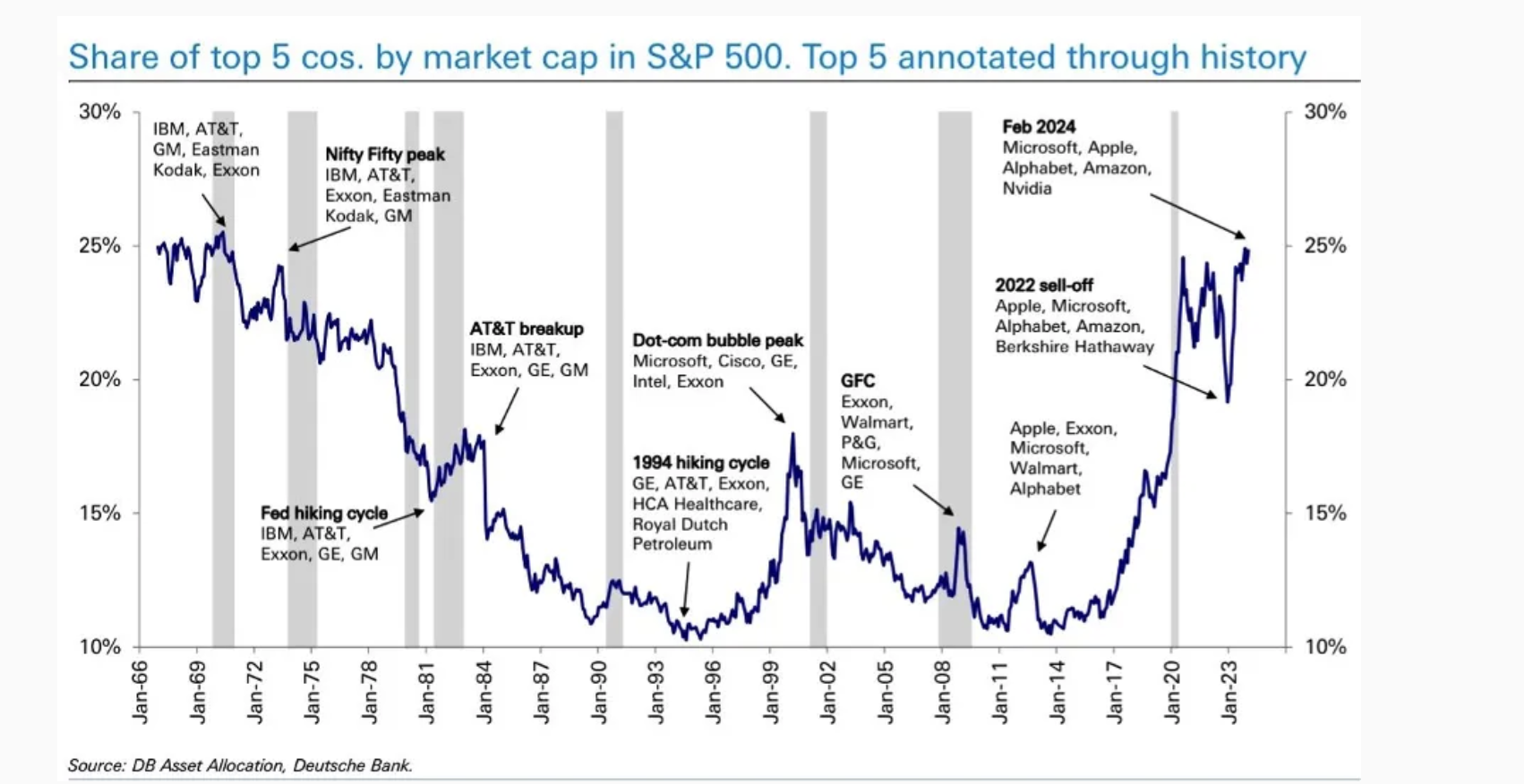

Market Concentration

Share of Top 5 Companies in S&P 500

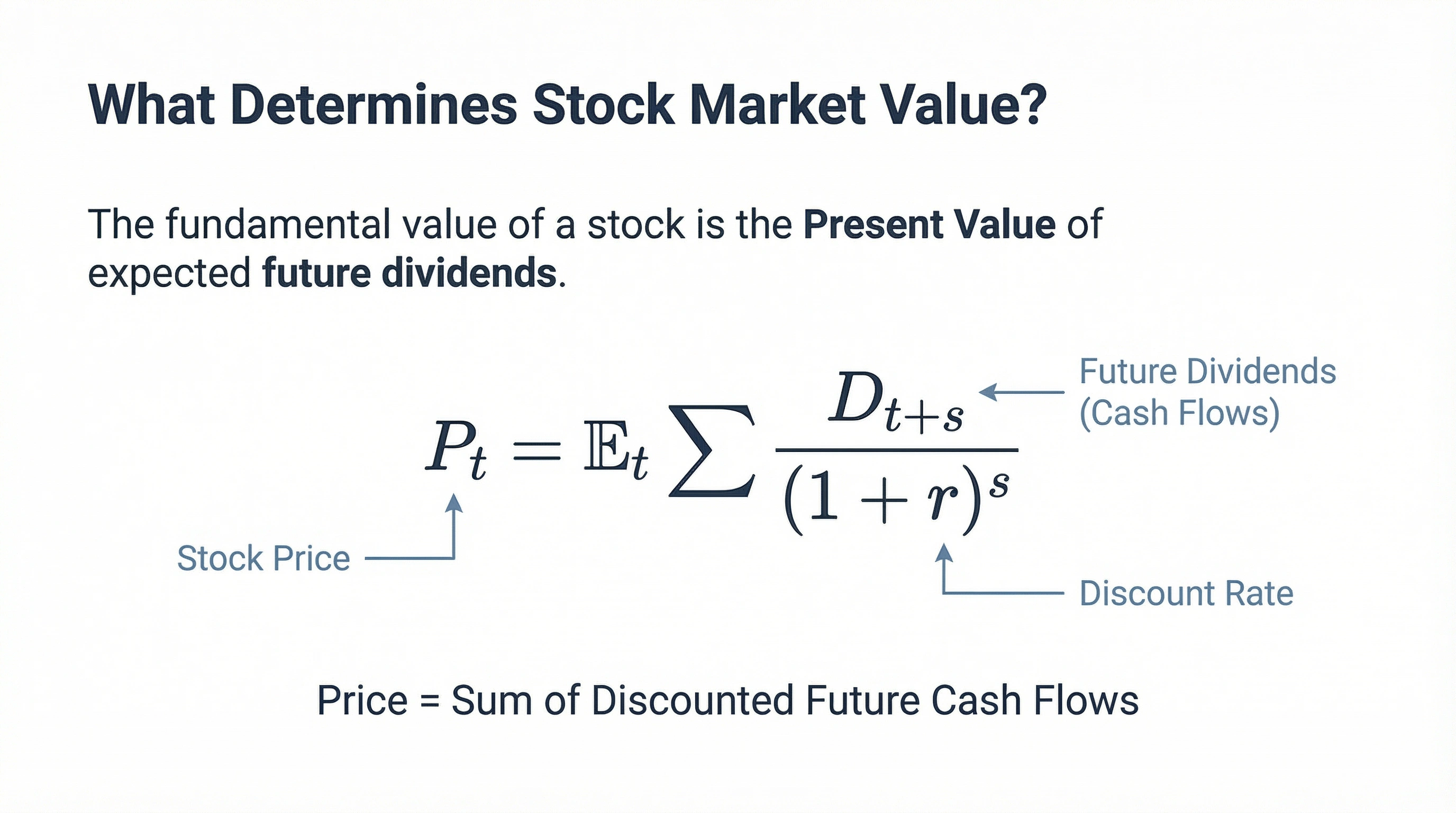

Stock Market Value

The Present Value Model

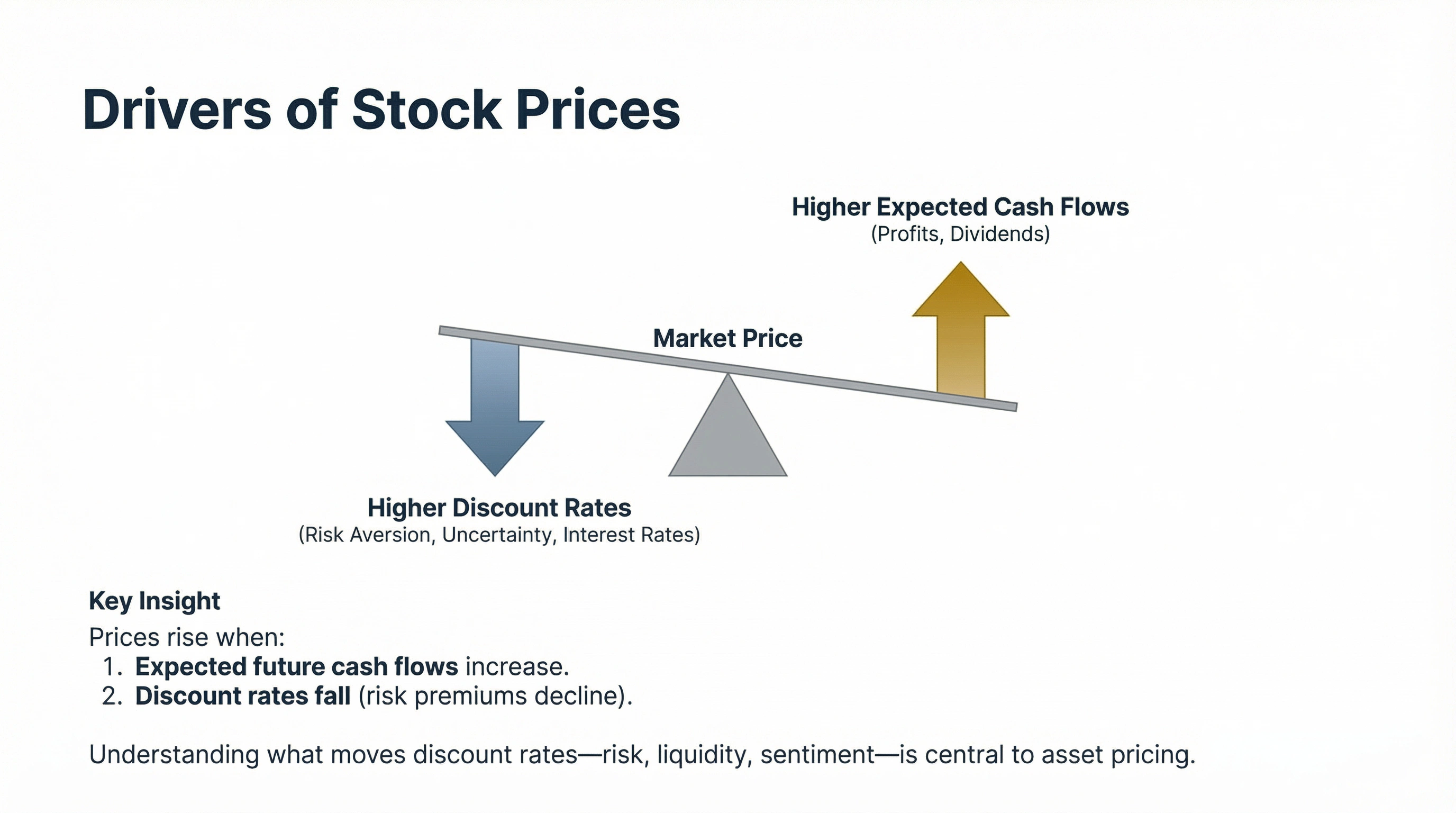

Drivers of Prices

Cash Flows vs. Discount Rates

Open Questions in Finance

Pricing, Structure, and Risk

Drivers of cash flows and discount rates remain elusive (Asset Pricing Puzzles).

A large part of the business capital is now privately-held, complicating measurement.

Concentration of stocks has significant implications for diversification and risk.

Part VII: Applications

Trade, Prices, and Cost Disease

Why Health Markets Fail?

Uncertainty and Asymmetric Information

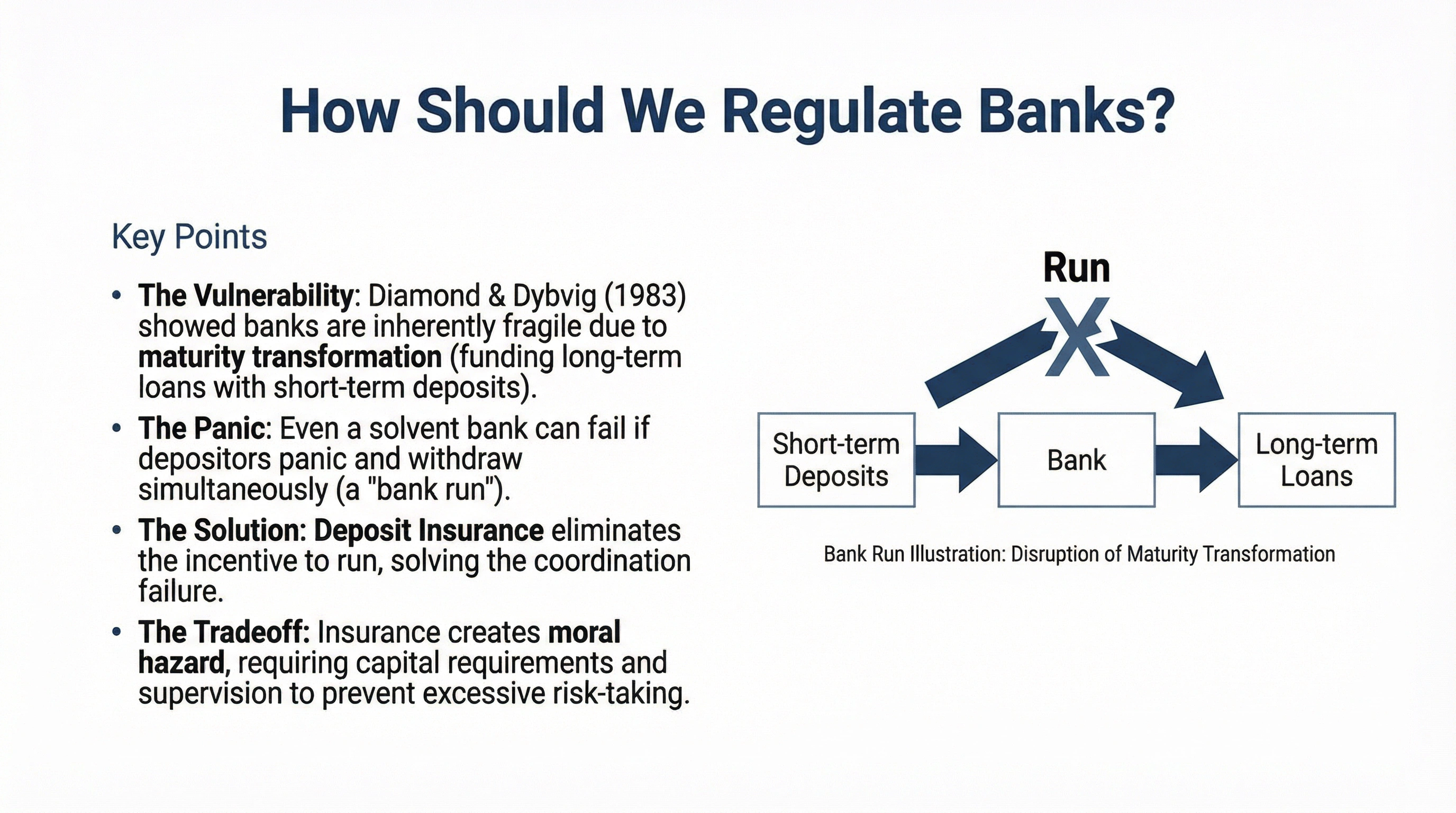

How Should We Regulate Banks?

Bank runs and deposit insurance

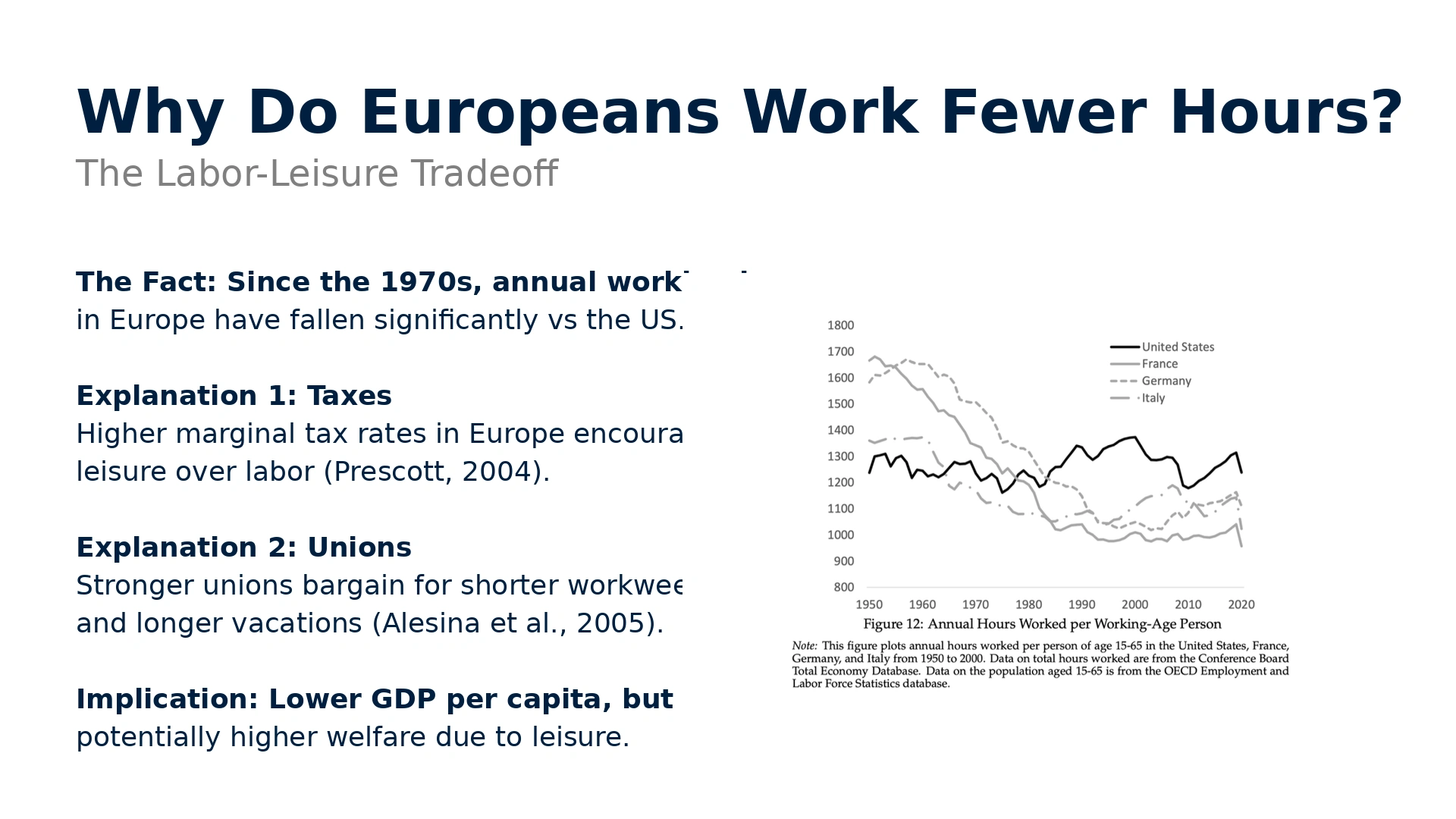

Why Do Europeans Work Fewer Hours?

The Labor-Leisure Tradeoff

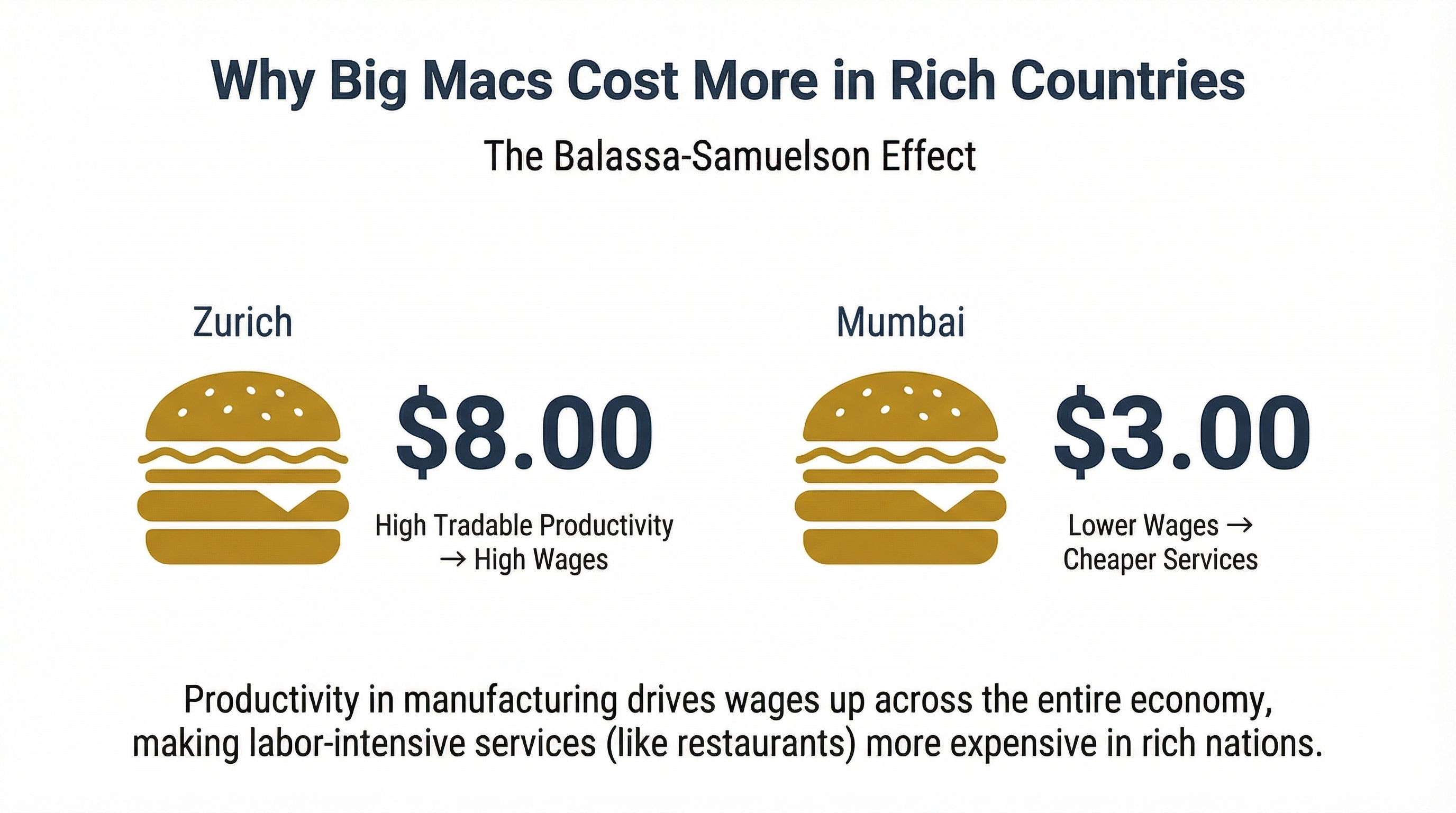

The Big Mac Index

The Balassa-Samuelson Effect

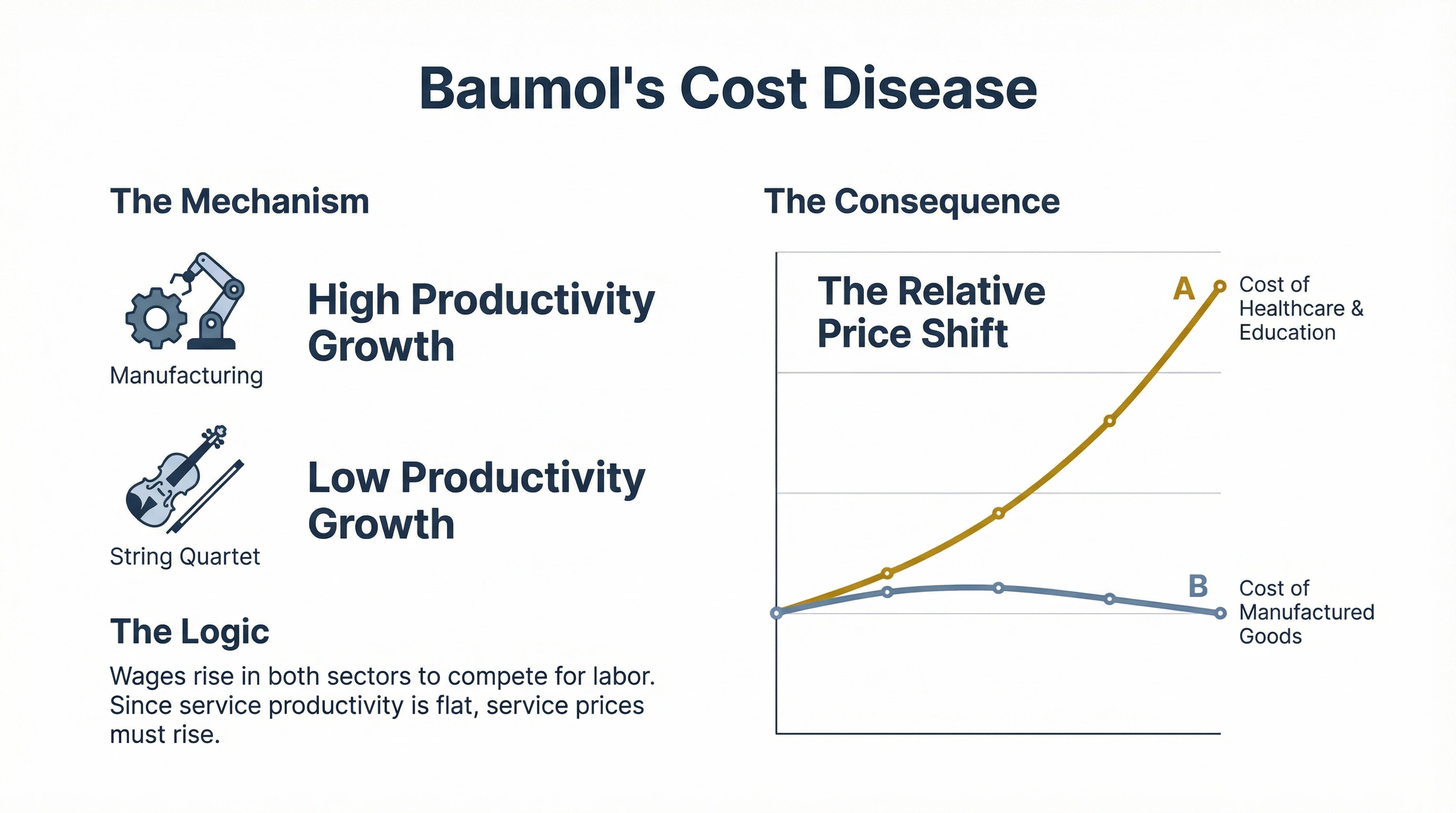

Why Do Health Care and Education Keep Getting More Expensive?

The Answer: Baumol's Cost Disease

Conclusion: Making a Miracle

Robert Lucas (1993)